New IRS data: Illinois lost migration battles with every Midwestern state

A new data release from the Internal Revenue Service can only be described as a complete embarrassment for the Prairie State.

Illinoisans have voted with their feet. The winner? Anywhere else in the Midwest.

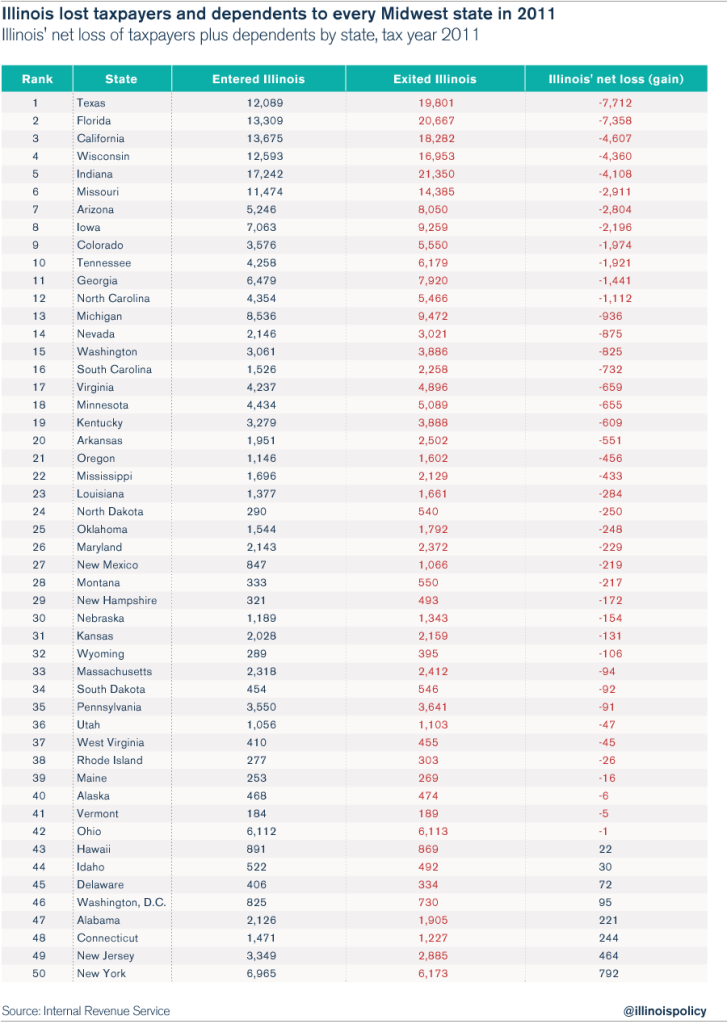

The

Land of Lincoln lost head-to-head migration battles with 42 out of 50

states, plus Washington, D.C., in tax year 2011, according to new

taxpayer-migration data released by the Internal Revenue Service on

July 31. That includes losing people to every other state in the

Midwest, the first time that Illinois lost to every regional competitor

in recorded IRS history, which goes back to 1990. The 2011 tax year was

the first year of Illinois’ historic income-tax hike, when the state

raised the income-tax rate by 67 percent.

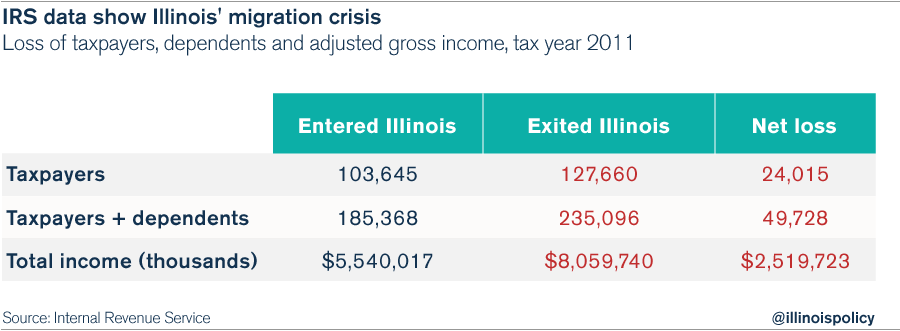

Illinois

lost 24,000 taxpayers along with 26,000 dependents on net that year,

for a total net loss of 50,000 people to other states. And when these

taxpayers left, they took their incomes with them. The net loss of

adjusted gross income for the state of Illinois was $2.5 billion in the

2011 tax year. Illinois’ loss of annual income jumped by $600 million

from the 2010 migration data, when Illinois had a net loss of $1.9 billion.

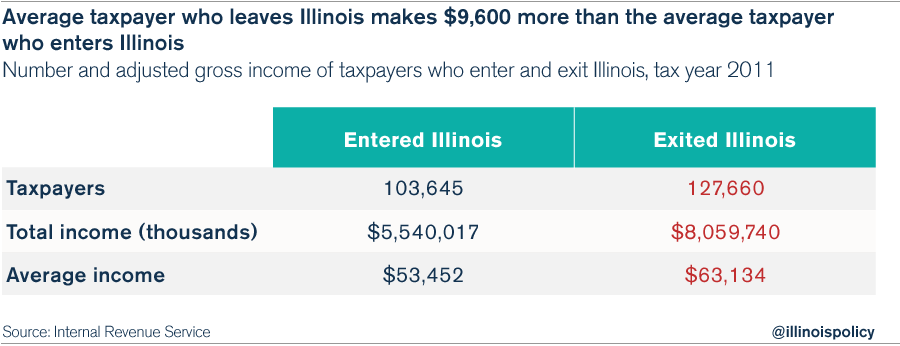

Those

who left Illinois tended to make more money than those who entered the

state. The average adjusted gross income of those who left Illinois was

$63,100, compared to an average adjusted gross income of $53,500 for

those who moved into Illinois. So not only was Illinois losing more

taxpayers than it gained, but those who left Illinois also earned 18

percent more than those who came in.

However,

the really shocking news from this IRS data release is the fact that

Illinois lost residents to every single state in the Midwest. The

historical trend was for Illinois to gain a few people from Rust Belt

peers such as Michigan and Ohio, along with the Dakotas. That trend

appears to have changed. Illinois hit a new low and lost people to every

other place in the Midwest, and also suffered big losses to Sun Belt

states.

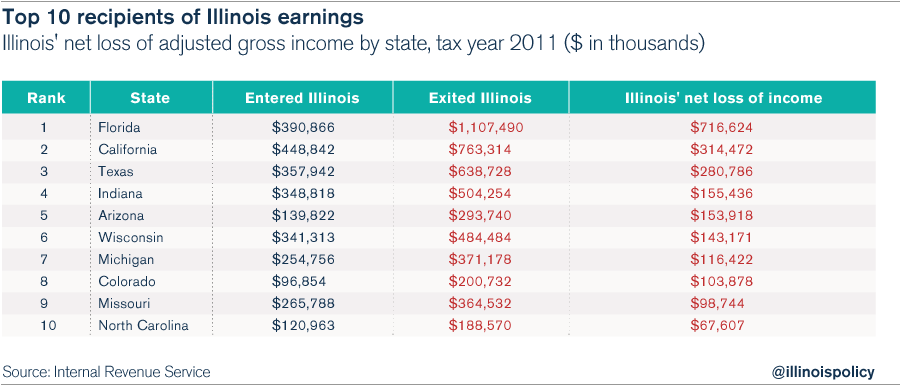

The

loss of taxpayers and their dependents was largely correlated with the

loss of annual income. Illinois had a net loss of annual income to 40

out of 50 states, plus Washington, D.C. The top 10 recipients of

Illinois earnings include large states such as Florida, California and

Texas, and also neighbors such as Indiana, Wisconsin, Michigan and

Missouri.

It’s

not surprising then that a population so disenchanted with that status

quo voted to change leadership at the top by electing Gov. Bruce Rauner.

It’s also not surprising that the reforms Rauner proposed, which are

completely in line with what neighboring states have been doing, are

perceived as such a major shift by the entrenched leadership of the

Illinois General Assembly. Those leaders, particularly House Speaker

Mike Madigan and Senate President John Cullerton, have shepherded

decades of misguided policies that drove up debt and pushed out

taxpayers.

There’s

a reason Illinoisans took an “anywhere but here” approach to their

beloved home state as early as 2011, many years before Rauner was even a

candidate for governor. Illinois’ legislative bosses should take note

of the fact that every other place in the region is being chosen over

the turf they control. If they care to change that, Rauner’s five clear legislative reforms are on the table, waiting to be called for a vote.

Note: IRS migration data should not be confused with U.S. Census Bureau migration data.

The IRS data are an important input for the Census Bureau’s data, but

the census data usually show larger changes in the number of people

moving. This is because IRS data capture only taxpayers and their

dependents, while the Census Bureau also estimates the movement of

people who are not filing taxes, such as new students out of college.

No comments:

Post a Comment