Friday, August 9, 2024

Monday, January 29, 2024

How Much Ocean Heating is Due To Deep-Sea Hydrothermal Vents?

How Much Ocean Heating is Due To Deep-Sea Hydrothermal Vents?

January 29th, 2024 by Roy W. Spencer, Ph. D.

I sometimes see comments to the effect that recent ocean warming could be due to deep-sea hydrothermal vents. Of course, what they mean is an INCREASE in hydrothermal vent activity since these sources of heat are presumably operating continuously and are part of the average energy budget of the ocean, even without any long-term warming.

Fortunately, there are measurements of the heat output from these vents, and there are rough estimates of how many vents there are. Importantly, the vents (sometimes called “smokers”) are almost exclusively found along the mid-oceanic ridges, and those ridges have an estimated total length of 75,000 km (ref).

So, if we had (rough) estimates of the average heat output of a vent, and (roughly) know how many vents are scattered along the ridges, we can (roughly) estimate to total heat flux into the ocean per sq. meter of ocean surface.

Direct Temperature Measurements Near the Vents Offer a Clue

A more useful observation comes from deep-sea surveys using a towed sensor package which measures trace minerals produced by the vents, as well as temperature. A study published in 2016 described a total towed sensor distance of ~1,500 km just above where these smokers have been located. The purpose was to find out just how many sites there are scattered along the ridges.

Importantly, the study notes, “temperature anomalies from such sites are commonly too weak to be reliably detected during a tow“.

Let’s think about that: even when the sensor package is towed through water in which the mineral tracers from smokers exist, the temperature anomaly is “too weak to be reliably detected”.

Now think about that (already) extremely weak warmth being mixed laterally away from the (relatively isolated) ocean ridges, and vertically through 1,000s of meters of ocean depth.

Also, recall the deep ocean is, everywhere, exceedingly cold. It has been calculated that the global-average ocean temperature below 200m depth is 4 deg. C (39 deg. F). The cold water originates at the surface at high latitudes where it becomes extra-salty (and thus dense) and it slowly sinks, filling the global deep oceans over thousands of years with chilled water.

The fact that deep-sea towed probes over hydrothermal vent sites can’t even measure a temperature increase in the mineral-enriched water means there is no way for buoyant water parcels to reach up several kilometers to reach the thermocline.

Estimating The Heat Flux Into the Ocean from Hydrothermal Vents

We can get some idea of just how small the heat input is based upon various current estimates of a few parameters. The previously mentioned study comes up with a possible spacing of hydrothermal sites every ~10 km. So, that’s 7,500 sites around the world along the mid-oceanic ridges. From deep-sea probes carrying specialized sampling equipment, the average energy output looks to be about 1 MW per vent (see Table 1, here). But how many vents are there per site? I could not find a number. They sampled several vents at several sites. Let’s assume 100, and see where the numbers lead. The total heat flux into the ocean from hydrothermal vents in Watts per sq. meter (W m-2) would then be:

Heat Flux = (7,500 sites)x(100 vents per site)x(1 MW per vent)/(360,000,000,000,000 sq. m ocean sfc).

This comes out to 0.00029 W m-2.

That is an exceedingly small number, about 1/4,000th of the 1 W m-2 estimated energy imbalance from Argo float measurements of (very weak) ocean warming over the last 20 years or so. Even if the estimate is off by a factor of 100, the resulting heat flux is still 1/40th of global ocean heating rate. I assume that oceanographers have published some similar estimates, but I could not find them.

Now, what *is* somewhat larger is the average geothermal heat flux from the deep, hot Earth, which occurs everywhere. That has a global average value of 0.087 W m-2. This is approximately 1/10 of the estimate current ocean heating rate. But remember, it’s not the average geothermal heat flux that is of interest because that is always going on. Instead, that heat flux would have to increase by a factor of ten for decades to cause the observed heating rate of the global deep oceans.

Evidence Ocean Warming Has Been Top-Down, Not Bottom-Up

Finally, we can look at the Argo-estimate vertical profile of warming trends in the ocean. Even though the probes only reach a little more than half-way to the (average) ocean bottom, the warming profile supports heating from above, not from below (see panel B, right). Given these various pieces of evidence, it would difficult to believe that deep-sea hydrothermal vents — actually, an increase in their heat output — can be the reason for recent ocean warming.

Monday, October 23, 2023

Colorado's final wolf reintroduction plan has been approved

Colorado's final wolf reintroduction plan has been approved. Here are the highlights.

Miles Blumhardt

Miles BlumhardtThe Colorado Wolf Restoration and Management plan has been approved after nearly two years of exhaustive work.

The Colorado Wildlife Commission unanimously approved the final plan at its May 3 meeting in Glenwood Springs.

The plan was developed with the help of two advisory groups made up of wildlife professionals and varied stakeholders, through a series of public meetings and more than 4,000 comments.

What states will reintroduced wolves come from, how many wolves will be released and where will wolves be released?

- Idaho, Montana and Wyoming are the desired states, with other possible donor states including Oregon and Washington, though a 9News story says source states are unwilling or have had little to no communication with Colorado regarding the issue.

- 10 to 15 wolves will be released per year, for a total of 30 to 50 wolves over the next three years depending on recovery success.

- Initial release site has been identified in an area with Glenwood Springs on the west, Kremmling on the north, Vail on the east and Aspen on the south. The area includes Interstate 70 running through the middle. The release sites would be focused on state and private land where there are willing owners.

How we got here:What to know about Colorado's existing wolves and conflicts around reintroduction plan

How many wolves will need to be established for wolves to be downlisted from endangered to threatened to delisted?

- Downlisting from state endangered to state threatened will occur when a minimum count of 50 wolves anywhere in the state for four successive years is met.

- Delisting from threatened to nongame status will occur when a minimum count of at least 150 wolves anywhere in Colorado is observed for two successive years, or a minimum count of at least 200 wolves at any time with a geographical distribution component through a finding that the species "is present in a significant portion of its range."

Will wolves be allowed to be killed in certain situations?

- Currently, wolves are listed as federally endangered in Colorado and can only be legally killed if threatening human life.

- Colorado requested a 10(j) ruling under the Endangered Species Act and is awaiting a determination by the federal government. The state is hoping for a resolution by Dec. 15, just two weeks before state officials wish to release wolves by the end of the year. The 10(j) rule lists wolves as "experimental" and would allow more flexibility managing them, including lethal take of wolves in situations such as chronic depredation or wolves caught depredating livestock.

- Colorado Senate Bill 23-256 introduced in this year's legislature originally precluded reintroduction until a determination of the 10(j) rule is finalized. An amendment to the original bill deleted this part of the bill over concern it would likely delay reintroduction. The bill is in the House or Representatives awaiting further debate. The legislative season ends May 6.

More: Colorado wolvesNorth Park wolfpack member confirmed to have wandered into Grand County

Will a hunting season of wolves be allowed when wolves are delisted?

- Proposition 114, narrowly approved by voters, designated wolves as nongame, meaning the animals cannot be hunted, but the commission could have the power to change that.

- The original plan included a Phase 4 that looked at the possibility of a hunting season when wolves are delisted. That has been removed and now basically defers actions regarding a hunting season to be assessed by future Colorado Wildlife Commissions.

Gun-Grabbers Break Out These 4 Common Myths Every Time There's a Shooting

Op-Ed: Gun-Grabbers Break Out These 4 Common Myths Every Time There's a Shooting

By Mitch Behna May 13, 2023 at 1:13pmWith this type of violence, debates about the Constitution are always brought forward. The Second Amendment is under attack probably more than any other amendment in our Bill of Rights.

The Second Amendment states: “A well regulated Militia, being necessary to the security of a free State, the right of the people to keep and bear Arms, shall not be infringed.”

In response to this most recent mass shooting, anti-gun advocates are once again demanding more gun restrictions.

Here are four common myths surrounding the Second Amendment and gun control.

1. A “well-regulated militia” means gun regulations.

Anti-gun advocates frequently cite the “well-regulated militia” clause. They often believe this refers to gun restrictions or needing to be part of a militia to own firearms.

But upon further analysis, this is not the case. A “well-regulated militia” simply refers to the American people.

“The militia system, with deep roots in English history, was one way of ensuring that the nation could defend itself against all threats, foreign and domestic. Instead of a large full-time professional army, the government could, when needed, call upon the greater body of armed citizens to employ their personal firearms in the collective defense of the state or nation,” as The Heritage Foundation highlighted.

“A ‘well-regulated’ militia simply meant that the processes for activating, training, and deploying the militia in official service should be efficient and orderly, and that the militia itself should be capable of competently executing battlefield operations.”

The 2008 Supreme Court ruling in District of Columbia v. Heller also confirmed that the Second Amendment protects an individual right. Being part of a militia is not required to exercise that right.

2. The right to “keep and bear arms” does not apply to modern weaponry.

The left often claims we do not have a right to own AR-15s and “assault rifles” because they did not exist at the time the Founding Fathers drafted and ratified the Second Amendment.

But this makes little sense. It is analogous to saying free speech rights are not included on the internet or other modern forms of communication because they did not exist at the time the First Amendment was written.

The Founders were brilliant to use the term “arms” since it is a very generic term that includes many forms of firearms. If they specifically intended the amendment to protect the right to keep and bear muskets, all of the handguns and rifles we use today would be in legal jeopardy.

Rep. Jim Jordan highlighted this key distinction in a hearing earlier this year.

3. Gun control is the only action needed to prevent gun violence.

Gun control advocates say we need to “take action” or “do something” to address gun violence. But their definition of action is always more gun control on top of existing gun control that failed to prevent these shootings.

Despite the calls for more restrictions, it appears that the mall where the Texas shooting took place was already a gun-free zone.

This shows that criminals never obey existing gun laws and, as a result, the only ones who suffer are law-abiding citizens being unable to defend themselves.

More gun control is not the answer. Part of the solution is to eliminate gun-free zones to allow law-abiding citizens to carry a firearm and increase their chances of repelling a potential shooter in the first place.

4. Ted Cruz and Greg Abbott were responsible for the Texas mall shooting.

Unfortunately, we live in a time when gun control advocates blame political opponents when these deadly shootings take place.

Texas Sen. Ted Cruz and Gov. Greg Abbott were among those targeted by this type of rhetoric.

Politicians like California Rep. Eric Swalwell wasted no time smearing Cruz and claiming that he sides with the murderers over the victims.

Journalist Steven Beschloss was just one of many who said Abbott had blood on his hands.

Second Amendment advocates are not responsible for any shooting. The blame must be placed on the killers themselves.

If we are going to reduce gun violence, we need to repeal ineffective gun control laws and bring back a culture that instills good faith and morals.

Friday, October 13, 2023

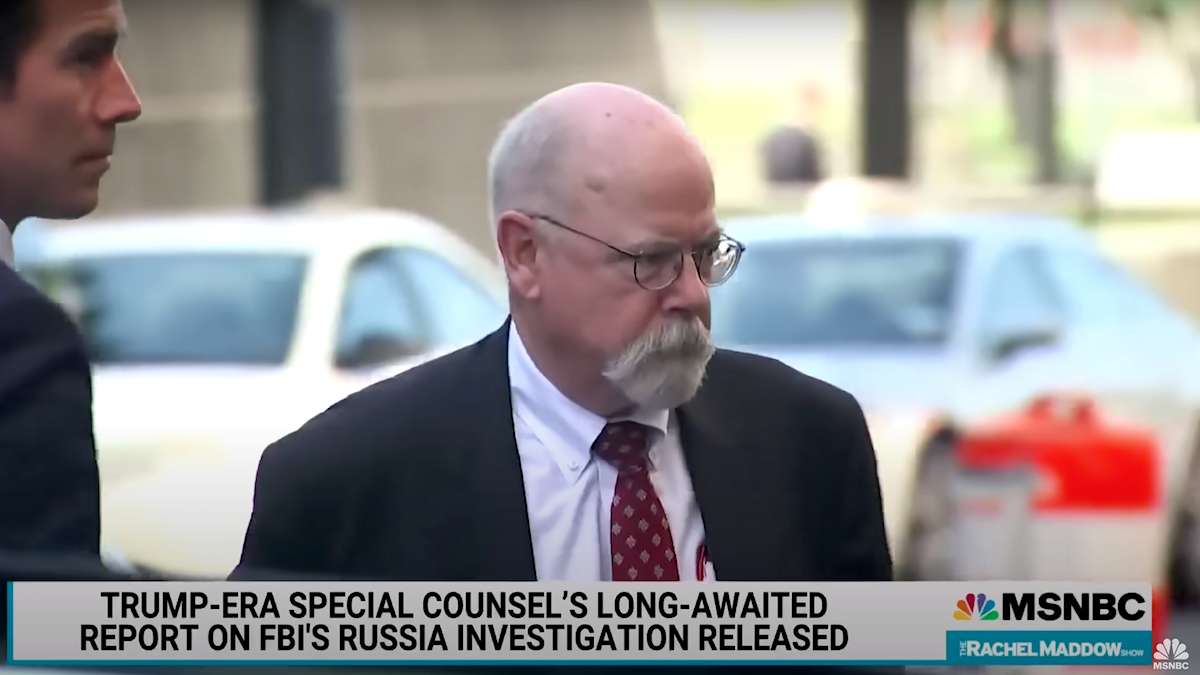

Don’t Miss The Most Damning Durham Finding

Don’t Miss The Most Damning Durham Finding

Special Counsel John Durham declared the DOJ and FBI’s hearts and minds corrupted.

Monday’s special counsel report detailed extensive evidence of Department of Justice and FBI misconduct concerning the launch and handling of the Crossfire Hurricane investigation, and equally overwhelming proof of partisan motives and double standards. While the facts are critical of both the bureau and the DOJ, more scandalous is John Durham’s conclusion that the inexcusable targeting of a political opponent cannot be prevented absent a curing of the corrupted hearts and minds of law enforcement and intelligence agencies.

Durham’s 306-page report opened with an executive summary capsulizing the results of the special counsel’s four-year investigation into the intelligence activities and investigations arising out of the 2016 presidential campaigns. While calling the findings “sobering,” and previewing the widespread misconduct on which the body of the report elaborated, Durham’s introductory comments emphasized he “does not recommend any wholesale changes in the guidelines and policies.”

It is here that Durham made his damning indictment of the DOJ and the FBI when he stressed that “the answer is not the creation of new rules but a renewed fidelity to the old.” Ultimately, he continued, justice “comes down to the integrity of the people who take an oath to follow the guidelines.” And “the promulgation of additional rules and regulations to be learned in yet more training sessions would likely prove to be a fruitless exercise if the FBI’s guiding principles of ‘Fidelity, Bravery and Integrity’ are not engrained in the hearts and minds of those sworn to meet the FBI’ s mission of ‘Protect[ing] the American People and Uphold[ing] the Constitution of the United States.’”

For the many details that followed — every misstep retraced and every inexplicable and unreasonable action condemned — that conclusion dwarfed them all. From the hurried opening of a full investigation of a presidential campaign based on unanalyzed and uncorroborated information to the fraudulent use of FISA warrants to the disregard of exculpatory evidence, Crossfire Hurricane represented a perfect storm of failures.

But what should terrify the country is not the catalog of malfeasance the special counsel recited — for mistakes and even gross failures can be corrected — but that Durham warned of corrupted hearts and minds, unfaithful to the people and their Constitution.

Telling too was that Durham opened and closed his 300-plus page report on the Russia-collusion hoax with homage to Attorney General Edward H. Levi. Appointed attorney general not long into President Ford’s term, Levi was “credited with restoring order after Watergate.” Supreme Court Justice Antonin Scalia would later say of Levi, he “brought the department through its worst years.”

But it was not merely Watergate. As Scalia detailed, “it was a bad time not only because of the disgrace of Watergate, which had affected the department most deeply, but there were also problems at the F.B.I.” At the time, the FBI had been conducting domestic surveillance operations, and under Levi’s leadership, regulations were put into place to limit the bureau’s abuse.

That history makes even more pronounced Durham’s introductory reminder that “the integrity of the people who take an oath to follow the guidelines and policies currently in place, guidelines that date from the time of Attorney General Levi,” is what ensures “the rule of law is upheld.”

Likewise, Levi’s role in reforming the FBI and bringing the DOJ out of the shadow of the Watergate scandal gives profound meaning to Durham’s decision to close the special counsel’s report like this:

‘Nothing,’ former Attorney General Levi warned, ‘can more weaken the quality of life or more imperil the realization of the goals we all hold dear than our failure to make clear by words and deed that our law is not the instrument of partisan purpose.’

For all the misconduct the special counsel exposed, it was Levi’s warning that Durham left us. And that, I fear, is the most significant revelation to come from the investigation: that after four years of inspecting the underbelly of the FBI, Durham saw a creature reminiscent of the one running wild under Nixon.

Sadly, Durham’s words are unlikely to resonate with Attorney General

Merrick Garland and FBI Director Christopher Wray. For they stand idly

by while history repeats itself with the favoritism previously shown to

Hillary Clinton now being bestowed on Hunter Biden and the Biden family.

But the special counsel’s entreat could still succeed from the bottom

up if the honorable and faithful men and women of the FBI join the ranks

of whistleblowers and revolt against those leaders corrupted in heart

and mind.

Thursday, May 18, 2023

Let’s Compare Media’s Lies About The Durham Report With What The Report Actually Said

Let’s Compare Media’s Lies About The Durham Report With What The Report Actually Said

It’s not as if John Durham is hiding the ball. He notes there were equal opportunities to investigate Clinton’s campaign in 2016, but those were handled more discreetly.

As with every major revelation proving them to be the treacherous, anti-democratic demons they are, the corporate media have instantly gone to work sweeping away the shocking conclusions of Special Counsel John Durham’s report on the FBI’s conduct as it related to its 2016 investigation of Donald Trump and Russia.

Years of work went into this thing, and the media believe all of its heinous discoveries can be set aside with a few news briefs belittling them as minor, unimpressive matters of mistake and “shortcomings.”

That’s not what Durham found. What he found was explicit bias within the world’s most powerful law enforcement agency against a democratically chosen presidential nominee.

The report, released Monday, is more than 300 pages, many of which recount information pieced together by Republicans in Congress and right-leaning journalists. But everything you need to know is in Durham’s summary, which, as tactfully as possible, describes the FBI’s 2016 investigation into Trump as not only without a foundation, but driven by political bias, dishonesty, and an appalling degree of personal animus.

The media won’t relay those facts from the report honestly because, of course, the media were complicit in the absolute con from the start. They hated Trump more than top officials at the FBI did and were more than happy to fan the flames that terrified the nation for years and irreparably crippled Trump’s entire term.

With that in mind, this is how big media described Durham’s findings versus what Durham actually said.

New York Times: “Mr. Durham’s 306-page report revealed little substantial new information about the inquiry, known as Crossfire Hurricane, and it failed to produce the kinds of blockbuster revelations accusing the bureau of politically motivated misconduct that former President Donald J. Trump and his allies suggested Mr. Durham would uncover.”

That suggests there was no proof or even significant evidence in Durham’s report that the FBI was hounding Trump for any reason outside of standard, dry agency business. That’s false.

What the report actually said: “Our investigation … revealed that senior FBI personnel displayed a serious lack of analytical rigor towards the information that they received, especially … from politically affiliated persons and entities. … In particular, there was significant reliance on investigative leads provided or funded (directly or indirectly) by Trump’s political opponents. The Department did not adequately examine or question these materials and the motivations of those providing them…”

In other words, the FBI willingly accepted allegations from Trump’s political rivals, treating them as objective data, rather than what they were: traditional campaign waste material.

Associated Press: “The report, the culmination of a four-year investigation into possible misconduct by U.S. government officials, contained withering criticism of the FBI but few significant revelations.”

That gives the impression that Durham’s report was a symbolic reprimand of no consequence. That’s false.

Here’s from the actual report: “FBI personnel … acknowledge[d] — both then and in hindsight — that they did not genuinely believe there was probable cause to believe that the [Trump campaign] was knowingly engaged in clandestine intelligence activities on behalf of a foreign power, or knowingly helping another person in such activities.”

In essence, FBI agents participating in the investigation were insincere in their efforts to find a sinister link between Trump’s campaign and Russia, because they knew it wasn’t likely to exist and didn’t believe there was a reason to try finding it anyway.

USA Today: “Special counsel John Durham criticizes FBI Trump-Russia probe, but recommends no wholesale changes.”

Mistakes were made but who among us?!

That’s not what Durham said. What he said is that the FBI abandoned its mission in pursuit of a political agenda and that if it had simply followed its own rules, one of the greatest political scandals in history would have never happened.

From Durham’s report: “[T]here is a continuing need for the FBI and the [Justice] Department to recognize that lack of analytical rigor, apparent confirmation bias, and an over-willingness to rely on information from individuals connected to political opponents caused investigators to fail to adequately consider alternative hypotheses and to act without appropriate objectivity or restraint in pursuing allegations of collusion or conspiracy between a U.S. political campaign and a foreign power. Although recognizing that in hindsight much is clearer, much of this also seems to have been clear at the time.”

It’s not as if Durham is hiding the ball. He notes in his report that there were equal opportunities to investigate Hillary Clinton’s campaign in 2016, but those were handled more discreetly, either by alerting the candidate’s team that it might have been targeted by potential foreign influence, or by simply dropping the matter altogether. (Hey, how about that?!)

Again, from the Durham report: “The speed and manner in which the FBI opened and investigated Crossfire Hurricane during the presidential election season based on raw, unanalyzed, and uncorroborated intelligence also reflected a noticeable departure from how it approached prior matters involving possible attempted foreign election interference plans aimed at the Clinton campaign.”

In short, there was a double standard — a political one. A democracy can’t sustain this kind of scandal perpetuated by its chief law enforcers. But the media gave up on that a long time ago.

Monday, May 15, 2023

Op-Ed: Gun-Grabbers Break Out These 4 Common Myths Every Time There's a Shooting

Op-Ed: Gun-Grabbers Break Out These 4 Common Myths Every Time There's a Shooting

By Mitch Behna May 13, 2023 at 1:13pmWith this type of violence, debates about the Constitution are always brought forward. The Second Amendment is under attack probably more than any other amendment in our Bill of Rights.

The Second Amendment states: “A well regulated Militia, being necessary to the security of a free State, the right of the people to keep and bear Arms, shall not be infringed.”

In response to this most recent mass shooting, anti-gun advocates are once again demanding more gun restrictions.

Here are four common myths surrounding the Second Amendment and gun control.

1. A “well-regulated militia” means gun regulations.

Anti-gun advocates frequently cite the “well-regulated militia” clause. They often believe this refers to gun restrictions or needing to be part of a militia to own firearms.

But upon further analysis, this is not the case. A “well-regulated militia” simply refers to the American people.

“The militia system, with deep roots in English history, was one way of ensuring that the nation could defend itself against all threats, foreign and domestic. Instead of a large full-time professional army, the government could, when needed, call upon the greater body of armed citizens to employ their personal firearms in the collective defense of the state or nation,” as The Heritage Foundation highlighted.

“A ‘well-regulated’ militia simply meant that the processes for activating, training, and deploying the militia in official service should be efficient and orderly, and that the militia itself should be capable of competently executing battlefield operations.”

The 2008 Supreme Court ruling in District of Columbia v. Heller also confirmed that the Second Amendment protects an individual right. Being part of a militia is not required to exercise that right.

2. The right to “keep and bear arms” does not apply to modern weaponry.

The left often claims we do not have a right to own AR-15s and “assault rifles” because they did not exist at the time the Founding Fathers drafted and ratified the Second Amendment.

But this makes little sense. It is analogous to saying free speech rights are not included on the internet or other modern forms of communication because they did not exist at the time the First Amendment was written.

The Founders were brilliant to use the term “arms” since it is a very generic term that includes many forms of firearms. If they specifically intended the amendment to protect the right to keep and bear muskets, all of the handguns and rifles we use today would be in legal jeopardy.

Rep. Jim Jordan highlighted this key distinction in a hearing earlier this year.

3. Gun control is the only action needed to prevent gun violence.

Gun control advocates say we need to “take action” or “do something” to address gun violence. But their definition of action is always more gun control on top of existing gun control that failed to prevent these shootings.

Despite the calls for more restrictions, it appears that the mall where the Texas shooting took place was already a gun-free zone.

This shows that criminals never obey existing gun laws and, as a result, the only ones who suffer are law-abiding citizens being unable to defend themselves.

More gun control is not the answer. Part of the solution is to eliminate gun-free zones to allow law-abiding citizens to carry a firearm and increase their chances of repelling a potential shooter in the first place.

4. Ted Cruz and Greg Abbott were responsible for the Texas mall shooting.

Unfortunately, we live in a time when gun control advocates blame political opponents when these deadly shootings take place.

Texas Sen. Ted Cruz and Gov. Greg Abbott were among those targeted by this type of rhetoric.

Politicians like California Rep. Eric Swalwell wasted no time smearing Cruz and claiming that he sides with the murderers over the victims.

Journalist Steven Beschloss was just one of many who said Abbott had blood on his hands.

Second Amendment advocates are not responsible for any shooting. The blame must be placed on the killers themselves.

If we are going to reduce gun violence, we need to repeal ineffective gun control laws and bring back a culture that instills good faith and morals.