[Strange, I thought this is what they wanted, to tax the wealthy more. I guess it's different when it's them] DGP

House Tax Plan Offers an Exceptionally Bad Deal for California, New York, New Jersey, and Maryland

November 14, 2017

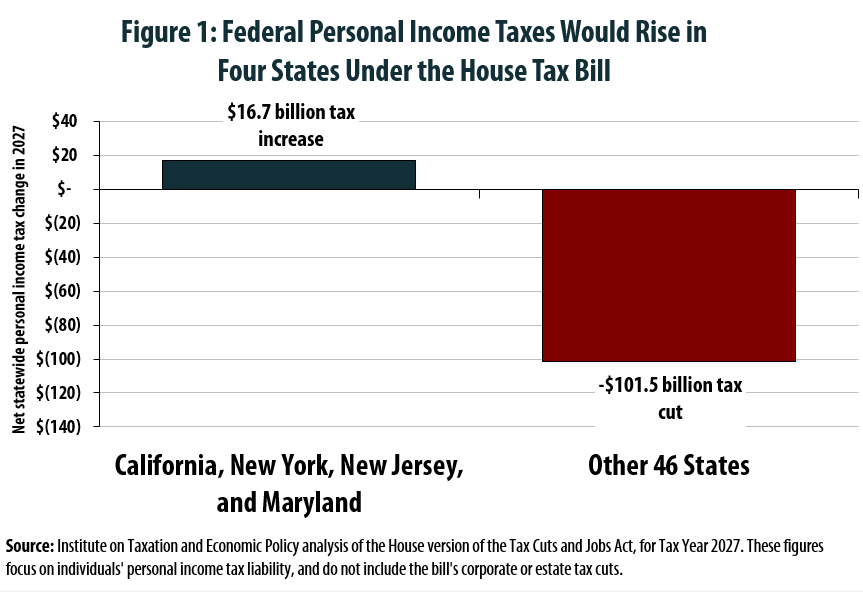

In effect, the tax increases falling on residents of these four states would be used to partly fund the tax cuts flowing to other parts of the country. ITEP estimates that the House bill would reduce federal personal income tax collections by a total of $84.8 billion in 2027, and that more than one-third (37 percent) of those cuts would flow to just two states—Florida and Texas. For context, these two states are expected to account for just 15 percent of nationwide personal income.

The highly uneven impact of the House’s Tax Cuts and Jobs Act is perhaps most apparent when looking at how the nation’s largest states would fare. Figure 3 shows that California and New York residents, as a group, could expect to pay $16.1 billion more in federal personal income taxes in 2027. Florida and Texas residents, by contrast, could expect their combined federal personal income tax payments to plummet by $31.2 billion in that same year.

No comments:

Post a Comment