How the election impacted Colorado real estate taxes

How the election impacted Colorado real estate taxes

Taxes are going up 164% in Denver County

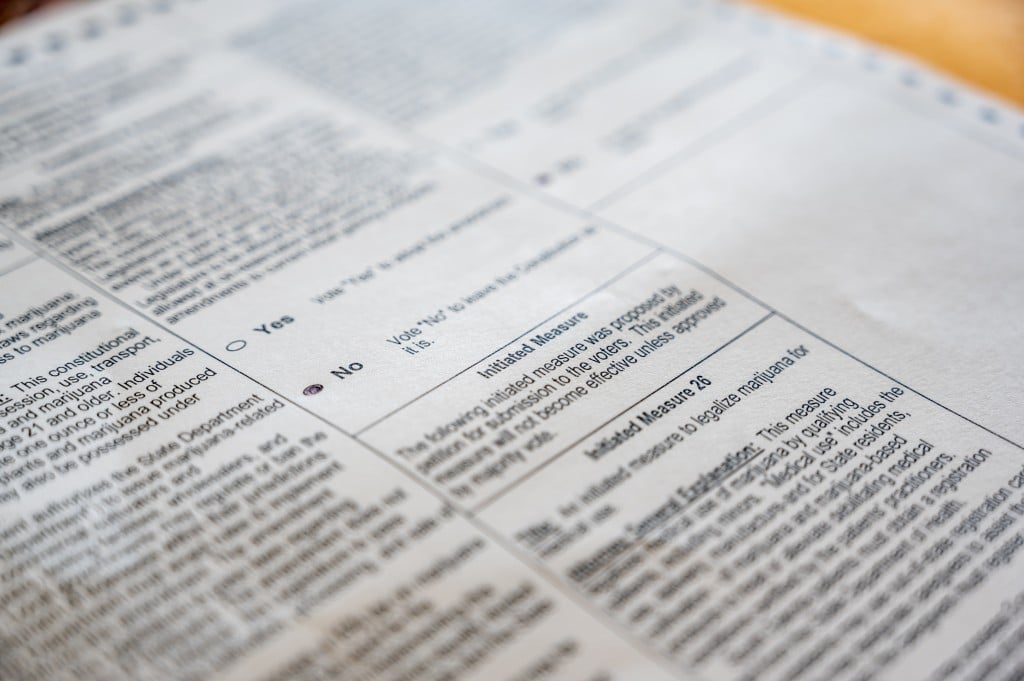

It has been quite the election cycle with lots of ups and down. One thing is certain, Colorado voters were in a spending mood which will result in Colorado property owners paying a lot more in taxes on everything, especially in Denver County.

Taxes in Denver will increase by $2400/year minimum for the median home. The biggest change is the repeal of the Gallagher amendment along with numerous bond and sales tax initiatives.

What does this mean for Colorado real estate?

How do Colorado Property taxes work now?

Under Colorado law there are amendments that govern how taxes are calculated. One of the major drivers of taxes is the Gallagher amendment. The Gallagher Amendment is like a balancing scale with two arms.

On one side are residential property values. On the other, non-residential values, such as commercial properties including minerals, like oil and gas. Residential property values can’t exceed roughly 45% of the statewide tax base whereas commercial properties account for the additional 55%.

When home values rise, or non-residential values fall, it tips the scales out of balance, and residential taxes are cut. The inverse can also occur with commercial property values dropping causing the scale to once again tip out of balance.

The Passage of Amendment B changes the game and your property taxes

I was very surprised this passed and that voters in our current economy voted for such a large property tax increase. I don’t think many voters fully understood the implications and the wording was a bit “optimistic”. The Gallagher amendment drastically slowed the growth of residential property taxes.

According to Colorado Public Radio, taxable property values in Denver have doubled in the last 20 years. Without Gallagher, that taxable base might have risen by a factor of five.

Under Gallagher, commercial properties “held back” residential property taxes as commercial values have risen at a much more measured pace than residential values.

Without Gallagher now and the passage of amendment B, your taxes will go up, up, and away! With the passage of amendment B, in 2021 (a revaluation year as Colorado values properties every odd year) there is going to be quite the sticker shock on tax bills as residential values have gone up close to 40% in the last two years in Denver and throughout most of the mountain communities.

Without Gallagher tax bills will rise in lockstep with property appreciation from now to eternity. The higher property tax rates will continue to contribute to the unaffordability of Denver and many cities throughout the front range and the resort communities.

What about TABOR

TABOR stands for the Taxpayer bill of rights and it seeks to limit the growth of Government based on population increases and inflation. Theoretically this would keep property taxes in check, but All but four of Colorado’s 178 school districts have already “de-Bruced.” (meaning they are not bound by TABOR and can continue to collect unlimited property taxes). Eighty-five percent of Colorado’s municipalities and 51 of 64 counties have also convinced their voters to let them opt out.

Other large taxes on the horizon

Denver County had a slew of taxes on the ballot. From mill levy increases, bond initiatives, and sales taxes. Here are some of the new initiatives that Denver County residents will now be paying.

- 2A: Climate tax: authorizing the city and county of Denver to levy an additional 0.25% sales tax generating an estimated $40 million per year to fund climate-related programs and programs designed to reduce greenhouse gas emissions and air pollution, thereby increasing the total sales tax rate in Denver from 8.31% to 8.56%.

- 2B: Homeless funding authorizing the city and county of Denver to levy an additional 0.25% sales tax generating an estimated $40 million per year to fund housing and homeless services, thereby increasing the total sales tax rate in Denver from 8.31% to 8.56%.

- 4A: Raises for school employees authorizing the district to levy an additional property tax of $150 per $100,000 in assessed value (1.5 mills) in 2021 and to increase that levy by up to $100 per $100,000 in assessed value (1 mill) every year to a maximum rate of $400 per $100,000 in assessed value (4 mills). Going into 2020, residential property was assessed at a rate of 7.15% of market value and non-residential property was assessed at 29% of market value. Under a 7.15% residential property tax assessment rate, a home with the median market value of about $470,000 would be assessed for taxes at $33,605, which means a 1 mill tax would be $33.6.

- 4B: School infrastructure authorizing the district to increase its debt by up to $795 million in bonds with a maximum repayment cost of $1.5 billion and to continue the district’s existing property tax rate to repay the bonds.

In a nutshell in Denver, sales tax rates increased by .5% and the mill levy increase by 4 mills, so assuming the median home price of 606,000, the tax bill would increase by about 2400/year minimum, if Denver continues to appreciate, which it likely will that number will be closer to 3000/year into perpetuity!

Property Taxes are rising, hang on tight to your real estate!

I’m amazed at the appetite for large tax increases in the economic cycle we are in. It is a bit ironic, that Denver passed massive tax hikes including one to fund housing. The higher tax rates are pushing out many of the constituents that they are trying to assist with housing! When property taxes rise, rental payments and mortgage payments also have to rise as the occupants must pay for the increased taxes. Let’s do a quick calculation of what 2021 will bring to everyone’s tax bill.

Recall properties are reassessed every odd year so 2021 and 2023 are reassessment years, there has been huge appreciation the last several years in most areas of the state and this appreciation looks to continue in Denver and the mountain resort communities. I did two scenarios, one for a median home in the front range (not Denver county) and then one for Denver county factoring in the new property tax initiatives:

Will tax increases impact property values?

At some point, the large property taxes will begin to impact property values as borrowers will need even more income to qualify for a loan (taxes and insurance are included in the mortgage payment calculation).

Income is not rising nearly as fast as real estate appreciation and taxes so less will be able to afford the house.

Furthermore, many commercial properties will also see a rise in taxes and these tax increases will have to be passed on to the tenants.

Note, the tax increases will not only impact property owners, anyone who pays rent will also see higher rents as the tax increases flow through to residential as well.

One of the largest drivers of appreciation in Colorado is the number of relocators from higher cost coastal areas like California or New York. Many times, they are leaving these areas due to large property and income tax bills.

As Colorado continues its upward trajectory of taxation, it will soon join the coastal club of expensive cities and at some point, see more migration out than in as people move to the next up and coming city with lower taxes.

When this will happen is anybody’s guess, but with the repeal of the Gallagher amendment and rapid increase in taxes it will happen sooner rather than later.

No comments:

Post a Comment