Home is where the hurt is: How property taxes are crushing Illinois’ middle class

by Austin Berg

Sticker shock

Joel Schurtz lived all across the U.S. before coming to Illinois. He took promising job opportunities where he could find them, from California to Alabama. His wife, Michelle, and their three young children would follow.

“Our family always had a plan,” Joel said. “We had three- to five-year goals and a plan. But when we came to Illinois that plan went out the window.”

Before the welcoming committee even arrived at their front door, the Schurtz family’s first property-tax bill arrived in the mail. “We laughed,” Michelle said. “That’s all we could do.”

The Schurtzes paid their first full year of property taxes in 2015. The bill totaled $11,000.

When it comes to property taxes, sticker shock is typical in Illinois. From small-business owners in Chicago to suburban dwellers in middle-of-the-pack school districts, long-time Illinoisans are often bewildered as to why they pay the second-highest property taxes in the nation, at an average of more than 2 percent of a home’s value.

And the nonpartisan Tax Foundation said Chicago’s record-setting property-tax hike will likely vault Illinois to the top of the table, making the Land of Lincoln home to the highest property taxes in the U.S.

But an average only tells so much of the story.

Property taxes become a second mortgage that homeowners can never pay off, or an endless expense for a small business that grows more costly each year. The Schurtz family’s first year of property taxes came out to 4 percent of the value of their Geneva, Illinois, home. For many Illinoisans, the burden is even heavier.

Job Varghese, an Indian-American immigrant who left his job with the federal government to strike out as a hospitality entrepreneur, pays $220,000 per year in property taxes on his southern Cook County hotel – more than he pays on the mortgage.

And it gets worse each year. Over the last 10 years, Varghese’s annual property-tax bill has risen by $70,000.

“If I moved my hotel three miles away from here [to Indiana], that $70,000 would be my entire property tax [for one year],” Varghese said.

“Our family came to this country for opportunity, but I find myself discouraging my son from working at our business here.”

A disturbing trend

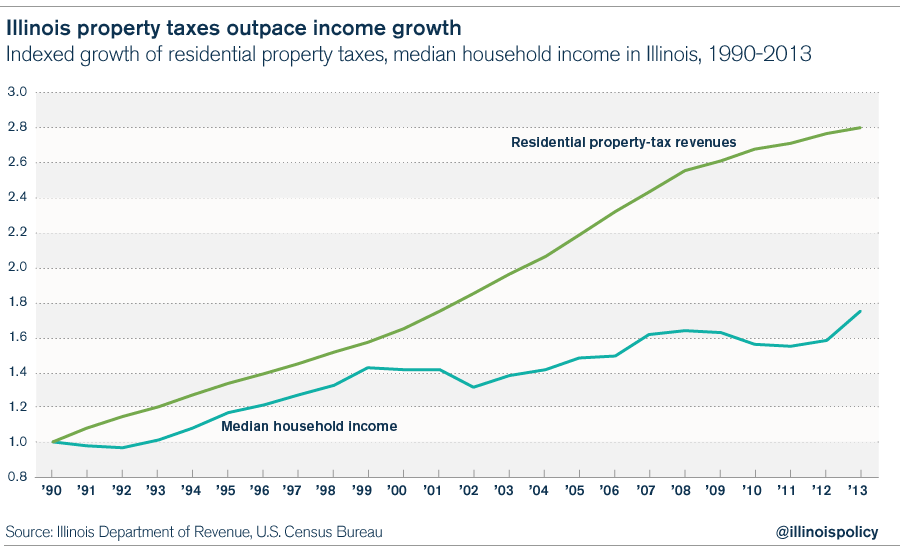

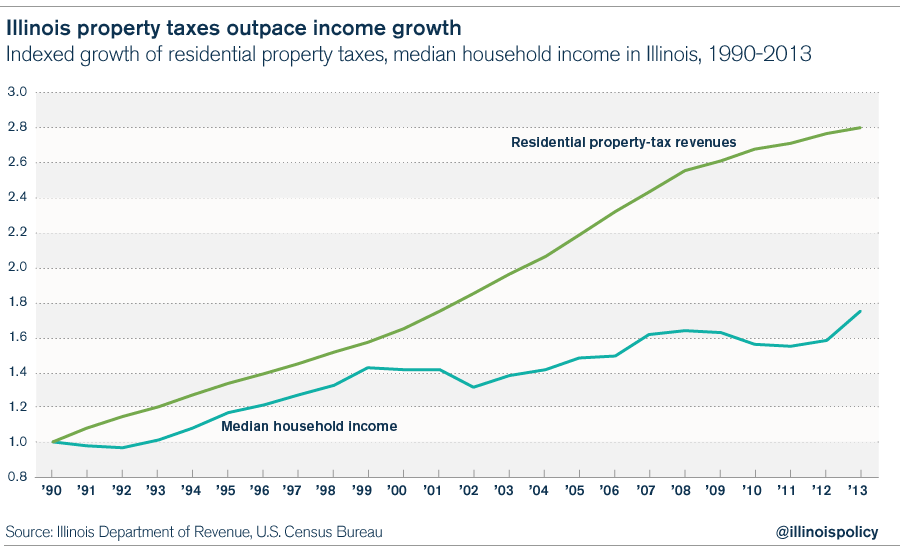

The pace and scale of property-tax growth over the last few decades in Illinois is overwhelming. Since 1990, residential property taxes have grown 3.3 times faster than the state’s median household income.

Simply put, Illinoisans’ property taxes are going up while salaries are stagnant at best.

Illinois Policy Institute research shows nearly every Illinois county has seen dramatic increases in its residents’ average property-tax burden since 1999.

Residential property taxes now eat up an average of 6.4 percent of a typical household income in Illinois. In 1990, that share was 3.6 percent. In this shift lies the pain currently felt by Illinoisans whose family budgets have been thrown into disarray.

Take Cassandra Bajak, a lifelong Illinoisan and mother of two. Bajak and her husband, an Army veteran, built their Crystal Lake home in 2002. Their children were born and raised there.

Over the last 13 years, the Bajaks’ property-tax bill has doubled. They now pay $1,500 a month in property taxes and insurance. Their mortgage payment is $1,100 a month.

“We’re being taxed out of our home,” Cassandra said.

“… [I]t’s basically like we’re renting our home from the government. [The rate] is well over 4 percent of what the house is worth. The only reason we would ever leave our home or this state is property taxes, and that’s what’s going to happen.”

Bajak said she and her husband plan to move their family to Florida within the next two years. Her reasoning is straightforward: “Taxes are less, and schools are the same,” she said.

Cassandra and her family are not alone.

In McHenry County, where the Bajaks reside, property taxes take up nearly 8 percent of the median household income. The average monthly property-tax bill stands at $499, and the typical property-tax burden in the county has ballooned by over 45 percent since 2000.

Suburban father Peter Brunk has felt the squeeze in Lake Villa, Illinois, which is located in Lake County. Brunk, too, has made plans for an Illinois exit in the near future.

Since his family moved into their home in 2010, the annual property-tax bill has risen by more than $2,300, or nearly 30 percent. Meanwhile, the value of his home actually decreased. The home’s assessed value, which is used to calculate property taxes, has dropped by 11 percent.

“I don’t really want to leave here,” Brunk said. “It’s a nice place. And it’s affordable because we’ve paid off our mortgage.”

“But I look at nine to 10 years [from now] when I retire … my property taxes will completely consume my Social Security check.”

The typical Lake County household’s property-tax burden has risen by 44 percent since 1999, with the average property-tax bill now coming in at more than $600 per month – the most expensive of any Illinois county.

Brunk’s most likely destination after his daughter graduates from high school? Florida. He said the difference in property taxes alone will more than pay for the move and a nicer home.

A closer look at government data reveals the cause behind the meteoric rise of Illinois property taxes, which forces people like Brunk out to greener pastures in other states.

Follow the money

When it comes to property taxes, four main factors drive the pinch felt in Illinois pocketbooks: government-worker pensions, government-worker health care, prevailing-wage requirements and workers’ compensation costs.

These four horsemen of fiscal doom are all multiplied by the sheer number of taxing bodies in Illinois – at nearly 7,000 – each with its own staffing and programming costs. No U.S. state comes close to Illinois on this number.

In Wauconda, Illinois, Mayor Frank Bart sees the squeeze on middle-class residents brought by these rising costs. After accounting for inflation, Wauconda’s median household income has dropped since 2009, according to U.S. Census Bureau estimates. But property-tax bills have continued to rise.

Why?

Take government-worker pension benefits, for example, which are mandated at the state level, regardless of whether local governments can afford them.

Bart expects police pensions to cost the village over $1 million annually within the next two years. The village has 25 police employees and a general fund budget of just over $9 million.

Bart uses his second-lowest paid police officer to illustrate the high personnel costs village taxpayers shoulder. The officer has been with the village for more than 10 years, and the village pays his $85,000 salary and $15,000 in benefits annually. On top of that, taxpayers contribute $25,000 to his pension each year, Bart said.

That’s not all.

Prevailing-wage laws levy another massive blow to local governments’ bottom lines. These laws can mandate six-figure salaries plus benefits for the lucky private-sector employees who work on government projects. Bart estimates this easily adds 20 percent to project costs above what would be offered in a competitive bidding process.

Finally, while Bart said effective departmental leadership has prevented workers’ compensation costs from getting out of hand in his community, this is not always the case.

Take Williamson County, for example, which has spent $2.7 million on workers’ compensation claims over the last three fiscal years, nearly four times as much as the previous three-year period.

“… [S]ome of this is frivolous,” said Chief Deputy Bob McCurdy, according to The Southern. “We need to make an example of somebody.”

County Board Chairman Jim Marlo echoed McCurdy’s concerns, describing the costs as “eating away” at the county budget.

“It is a system that[’s] easily manipulated in this state and until you get legislative action to change the way claims are handled, the way insurance handles and the way courts handle it, we are going to be faced with this problem,” Marlo said.

Turning the tables

A major effort to stop Illinois’ sky-high property tax rates from creeping even higher lies in House Bill 4224, which would freeze property taxes at current levels unless local voters approve a future property-tax increase. This legislation is part of Gov. Bruce Rauner’s Turnaround Agenda.

But a freeze alone won’t be enough. Property taxes would have to stay frozen for the next 28 years for Illinois residents’ property-tax burden to return to levels seen in 1990.

So it is important that HB 4224 also gives local governments more flexibility in controlling costs, such as allowing cash-strapped localities to narrow the scope of collective-bargaining agreements and to take less expensive bids for government work.

Another key component to easing residents’ property-tax burden will be aggressive consolidation and resource-sharing across Illinois’ thousands of local taxing bodies. DuPage County has taken the lead in this area. Other counties should follow suit.

When it comes to skyrocketing, unsustainable pension costs, Illinois’ local governments must also be empowered to take control of their fiscal futures by filing bankruptcy. Workers’ compensation reform to bring Illinois’ out-of-whack costs in line with those of surrounding states is another essential piece of the puzzle.

Local leaders in Illinois must actively avoid the ignominious title of the nation’s leader in taxing homeowners.

As average property-tax bills begin to bump up against average mortgage payments, communities will increasingly be ripped apart as people and businesses flee to areas where they need not pay twice for their property: once to the bank and once to the government.

Unfortunately, this is already happening. Many of Chicago’s south suburbs may have already crossed this line in the sand, and face a long, painful road to recovery. Numbers at the state level are equally concerning. Illinois has lost a greater share of its population to out-migration than any Midwestern state since 2010.

Susann D., a retired widow and longtime resident of Mt. Prospect, Illinois, best describes the angst among Illinois’ middle-class residents who can no longer shoulder the tax burden placed upon them by a broken system.

“… the property-tax increase is never a kind of earth-shattering amount,” she said. “But people have to make it work by cutting their budgets. I look online for houses like mine in other states on a similar size lot, and the property taxes are $400 a year. My property taxes here are $7,000 a year.”

“I do want to leave. But this is the most difficult question in my life,” she said.

“If I knew where I was going, that ‘For Sale’ sign would be in front of my house. But I have no family or friends anywhere else. What do I do? Where do I go?”

Susann’s poignant questions should be met with loud cries for reform from Springfield and across the state.

Sticker shock

Joel Schurtz lived all across the U.S. before coming to Illinois. He took promising job opportunities where he could find them, from California to Alabama. His wife, Michelle, and their three young children would follow.

“Our family always had a plan,” Joel said. “We had three- to five-year goals and a plan. But when we came to Illinois that plan went out the window.”

Before the welcoming committee even arrived at their front door, the Schurtz family’s first property-tax bill arrived in the mail. “We laughed,” Michelle said. “That’s all we could do.”

The Schurtzes paid their first full year of property taxes in 2015. The bill totaled $11,000.

When it comes to property taxes, sticker shock is typical in Illinois. From small-business owners in Chicago to suburban dwellers in middle-of-the-pack school districts, long-time Illinoisans are often bewildered as to why they pay the second-highest property taxes in the nation, at an average of more than 2 percent of a home’s value.

And the nonpartisan Tax Foundation said Chicago’s record-setting property-tax hike will likely vault Illinois to the top of the table, making the Land of Lincoln home to the highest property taxes in the U.S.

But an average only tells so much of the story.

Property taxes become a second mortgage that homeowners can never pay off, or an endless expense for a small business that grows more costly each year. The Schurtz family’s first year of property taxes came out to 4 percent of the value of their Geneva, Illinois, home. For many Illinoisans, the burden is even heavier.

Job Varghese, an Indian-American immigrant who left his job with the federal government to strike out as a hospitality entrepreneur, pays $220,000 per year in property taxes on his southern Cook County hotel – more than he pays on the mortgage.

And it gets worse each year. Over the last 10 years, Varghese’s annual property-tax bill has risen by $70,000.

“If I moved my hotel three miles away from here [to Indiana], that $70,000 would be my entire property tax [for one year],” Varghese said.

“Our family came to this country for opportunity, but I find myself discouraging my son from working at our business here.”

A disturbing trend

The pace and scale of property-tax growth over the last few decades in Illinois is overwhelming. Since 1990, residential property taxes have grown 3.3 times faster than the state’s median household income.

Simply put, Illinoisans’ property taxes are going up while salaries are stagnant at best.

Illinois Policy Institute research shows nearly every Illinois county has seen dramatic increases in its residents’ average property-tax burden since 1999.

Residential property taxes now eat up an average of 6.4 percent of a typical household income in Illinois. In 1990, that share was 3.6 percent. In this shift lies the pain currently felt by Illinoisans whose family budgets have been thrown into disarray.

Take Cassandra Bajak, a lifelong Illinoisan and mother of two. Bajak and her husband, an Army veteran, built their Crystal Lake home in 2002. Their children were born and raised there.

Over the last 13 years, the Bajaks’ property-tax bill has doubled. They now pay $1,500 a month in property taxes and insurance. Their mortgage payment is $1,100 a month.

“We’re being taxed out of our home,” Cassandra said.

“… [I]t’s basically like we’re renting our home from the government. [The rate] is well over 4 percent of what the house is worth. The only reason we would ever leave our home or this state is property taxes, and that’s what’s going to happen.”

Bajak said she and her husband plan to move their family to Florida within the next two years. Her reasoning is straightforward: “Taxes are less, and schools are the same,” she said.

Cassandra and her family are not alone.

In McHenry County, where the Bajaks reside, property taxes take up nearly 8 percent of the median household income. The average monthly property-tax bill stands at $499, and the typical property-tax burden in the county has ballooned by over 45 percent since 2000.

Suburban father Peter Brunk has felt the squeeze in Lake Villa, Illinois, which is located in Lake County. Brunk, too, has made plans for an Illinois exit in the near future.

Since his family moved into their home in 2010, the annual property-tax bill has risen by more than $2,300, or nearly 30 percent. Meanwhile, the value of his home actually decreased. The home’s assessed value, which is used to calculate property taxes, has dropped by 11 percent.

“I don’t really want to leave here,” Brunk said. “It’s a nice place. And it’s affordable because we’ve paid off our mortgage.”

“But I look at nine to 10 years [from now] when I retire … my property taxes will completely consume my Social Security check.”

The typical Lake County household’s property-tax burden has risen by 44 percent since 1999, with the average property-tax bill now coming in at more than $600 per month – the most expensive of any Illinois county.

Brunk’s most likely destination after his daughter graduates from high school? Florida. He said the difference in property taxes alone will more than pay for the move and a nicer home.

A closer look at government data reveals the cause behind the meteoric rise of Illinois property taxes, which forces people like Brunk out to greener pastures in other states.

Follow the money

When it comes to property taxes, four main factors drive the pinch felt in Illinois pocketbooks: government-worker pensions, government-worker health care, prevailing-wage requirements and workers’ compensation costs.

These four horsemen of fiscal doom are all multiplied by the sheer number of taxing bodies in Illinois – at nearly 7,000 – each with its own staffing and programming costs. No U.S. state comes close to Illinois on this number.

In Wauconda, Illinois, Mayor Frank Bart sees the squeeze on middle-class residents brought by these rising costs. After accounting for inflation, Wauconda’s median household income has dropped since 2009, according to U.S. Census Bureau estimates. But property-tax bills have continued to rise.

Why?

Take government-worker pension benefits, for example, which are mandated at the state level, regardless of whether local governments can afford them.

Bart expects police pensions to cost the village over $1 million annually within the next two years. The village has 25 police employees and a general fund budget of just over $9 million.

Bart uses his second-lowest paid police officer to illustrate the high personnel costs village taxpayers shoulder. The officer has been with the village for more than 10 years, and the village pays his $85,000 salary and $15,000 in benefits annually. On top of that, taxpayers contribute $25,000 to his pension each year, Bart said.

That’s not all.

Prevailing-wage laws levy another massive blow to local governments’ bottom lines. These laws can mandate six-figure salaries plus benefits for the lucky private-sector employees who work on government projects. Bart estimates this easily adds 20 percent to project costs above what would be offered in a competitive bidding process.

Finally, while Bart said effective departmental leadership has prevented workers’ compensation costs from getting out of hand in his community, this is not always the case.

Take Williamson County, for example, which has spent $2.7 million on workers’ compensation claims over the last three fiscal years, nearly four times as much as the previous three-year period.

“… [S]ome of this is frivolous,” said Chief Deputy Bob McCurdy, according to The Southern. “We need to make an example of somebody.”

County Board Chairman Jim Marlo echoed McCurdy’s concerns, describing the costs as “eating away” at the county budget.

“It is a system that[’s] easily manipulated in this state and until you get legislative action to change the way claims are handled, the way insurance handles and the way courts handle it, we are going to be faced with this problem,” Marlo said.

Turning the tables

A major effort to stop Illinois’ sky-high property tax rates from creeping even higher lies in House Bill 4224, which would freeze property taxes at current levels unless local voters approve a future property-tax increase. This legislation is part of Gov. Bruce Rauner’s Turnaround Agenda.

But a freeze alone won’t be enough. Property taxes would have to stay frozen for the next 28 years for Illinois residents’ property-tax burden to return to levels seen in 1990.

So it is important that HB 4224 also gives local governments more flexibility in controlling costs, such as allowing cash-strapped localities to narrow the scope of collective-bargaining agreements and to take less expensive bids for government work.

Another key component to easing residents’ property-tax burden will be aggressive consolidation and resource-sharing across Illinois’ thousands of local taxing bodies. DuPage County has taken the lead in this area. Other counties should follow suit.

When it comes to skyrocketing, unsustainable pension costs, Illinois’ local governments must also be empowered to take control of their fiscal futures by filing bankruptcy. Workers’ compensation reform to bring Illinois’ out-of-whack costs in line with those of surrounding states is another essential piece of the puzzle.

Local leaders in Illinois must actively avoid the ignominious title of the nation’s leader in taxing homeowners.

As average property-tax bills begin to bump up against average mortgage payments, communities will increasingly be ripped apart as people and businesses flee to areas where they need not pay twice for their property: once to the bank and once to the government.

Unfortunately, this is already happening. Many of Chicago’s south suburbs may have already crossed this line in the sand, and face a long, painful road to recovery. Numbers at the state level are equally concerning. Illinois has lost a greater share of its population to out-migration than any Midwestern state since 2010.

Susann D., a retired widow and longtime resident of Mt. Prospect, Illinois, best describes the angst among Illinois’ middle-class residents who can no longer shoulder the tax burden placed upon them by a broken system.

“… the property-tax increase is never a kind of earth-shattering amount,” she said. “But people have to make it work by cutting their budgets. I look online for houses like mine in other states on a similar size lot, and the property taxes are $400 a year. My property taxes here are $7,000 a year.”

“I do want to leave. But this is the most difficult question in my life,” she said.

“If I knew where I was going, that ‘For Sale’ sign would be in front of my house. But I have no family or friends anywhere else. What do I do? Where do I go?”

Susann’s poignant questions should be met with loud cries for reform from Springfield and across the state.

No comments:

Post a Comment