What Was Behind Today's "Wow, Wow, Wow" Jobs Report

There was a loud gasp from Wall Street strategists and economists after today's job report printed, with the reactions more or less in line with sheer shock: anywhere from "wow, wow, wow"...

'WOW! WOW!' CNBC Anchor Stunned By Jobs Report Showing 517,000 Jobs Added — 'A Blastoff of a Number!' https://t.co/P8sxFQnJtG pic.twitter.com/WC4jMYt1Tr

— Tommy moderna-vaX-Topher (@tommyxtopher) February 3, 2023

... to "holy moly"

Holy moly what a report! Seasonal distortions & benchmarking aside people who want jobs can find them, and while the labor share of GDP isn't rising there is something extraordinary & good going on in the distribution of wage growth pic.twitter.com/4mf4ct9uvI

— Julia Coronado (@jc_econ) February 3, 2023

And with the unemployment rate plunging to 3.4% - matching the lowest in 54 years - from 3.6%, while the payrolls report showing the addition of 517K jobs the highest since July, and far above the highest forecast - in fact, a record 9-sigma beat to median consensus, the shock was merited as today's report was indeed a blowout.

But why: what happened that everyone was so wrong?

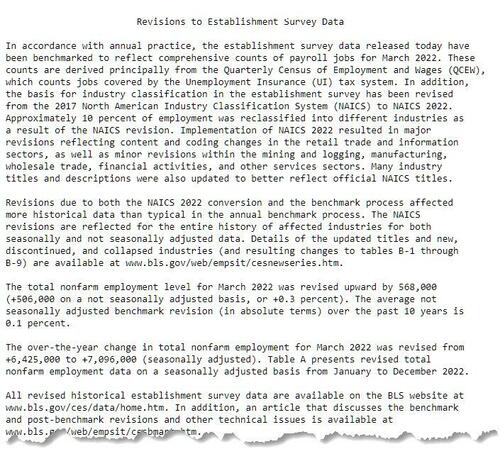

A couple of things. First, as we warned yesterday, today the BLS unveiled a slew of data revisions, which include updating the population controls – which would have the mechanical effect of boosting the labor force – and updating seasonal factors, which further distorted the January nonfarm payroll number (this is key as readers will read shortly). This is indeed what happened:

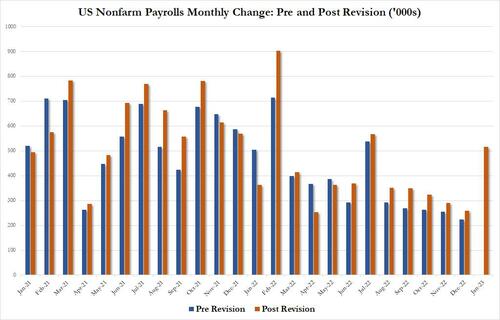

The revisions - in case there was any question - were to the upside, and made the Establishment survey data appear even stronger. A lot stronger in fact: there were upward revisions to all monthly payrolls reports starting with June 2022 as shown in the chart below.

In practical terms, whether the they were merited or purely goalseeked propaganda, the revisions helped to resolve the mystery of missing workers in the labor market. Fed Chair Jerome Powell and most analysts have estimated that about 2.5-3 million workers are “missing” – i.e., most analysts would expect many more workers to be working today if the pandemic hadn’t happened. Well, there was an 813k upward revision to the December payrolls report (which was revised from 153.743 million to 154.556 million) and which explained much of where the "missing workers" went: as expected, they were merely bits in some excel spreadsheet.

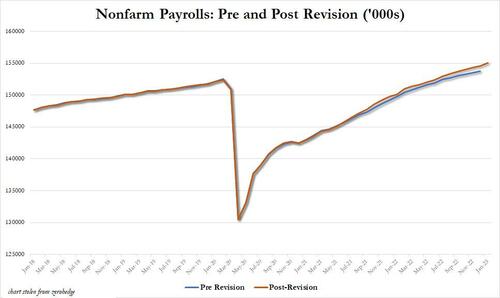

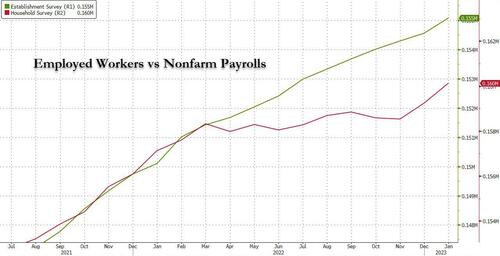

But the one place where the revisions were most notable was in the Household survey which is used to calculate the actual number of employed workers. What it showed was an even more remarkable surge in employment in January, which surged by a whopping 894K in January, and together with the upward revised 717K in December, a grand total of 1.6 million in two months...

.... that infamous divergence between the Household and Establishment surveys which showed zero employment gains from March until November, has almost closed.

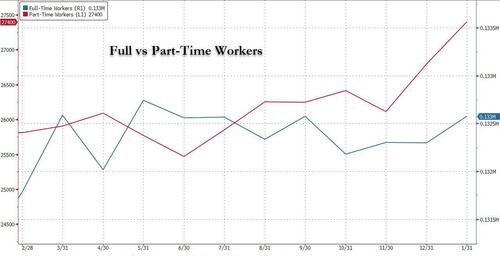

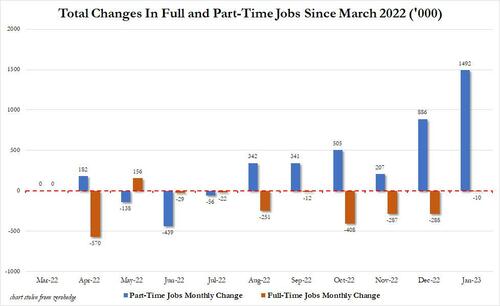

So good job BLS, for keeping an eye on this website which tends to point out what data makes no sense and you revising it appropriately. Only... maybe not. Because despite the massive revisions, what the BLS forgot to fix was the distribution between full time and part-time workers. And that's a whoppsie, because as shown in the chart below...

... the number of full-time workers in March 2022 was 132.587 million. Fast forward to January 2023 when it was 132.577: that's right: total US full-time workers declined by 10K over a period of 10 months. Meanwhile, part-time workers soared from 25.908 million to 27.400 million, an increase of 1.492 million!

So at least we know where the bulk of the increase in US labor came from in the past year: virtually no full-time jobs, and all part-time.

Ok, fine, but what about the January surge in Payrolls? Well, recall what we said last night: in our preview of today's payrolls we warned "It's not the January payrolls report. It's the January seasonal adjustment report. Lat year it was 2.9 million"...

It's not the January payrolls report. It's the January seasonal adjustment report. Lat year it was 2.9 million pic.twitter.com/Dn2CygV4FP

— zerohedge (@zerohedge) February 3, 2023

... and that today's number would be entire a function of the seasonal adjustment.

Guess what: it was. Because, while theadjusted payrolls print was an increase of 517K, the unadjusted was - oops - 2.5 million!

This is what Bloomberg chief economist Anna Wong put it: "The January jobs report showed extremely robust growth, higher than the highest estimate in the Bloomberg survey. If it seems too good to be true, that’s because it is too good to be true — the gain is mostly due to seasonal factors and revisions to past data. The Fed likely won’t place too much weight on this report in formulating policy."

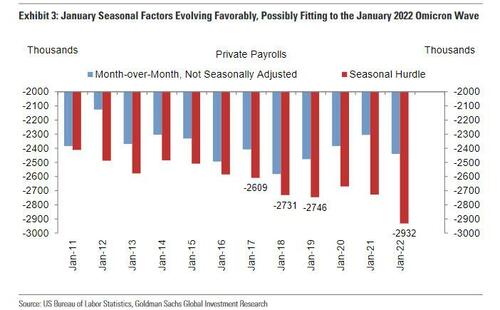

Readers knew this of course: in our NFP preview last night we quoted Goldman who said that "the January seasonal factors have evolved favorably in recent years, with a month-over-month hurdle for private payrolls of -2,829k in January 2022 compared to -2,695k on average in 2017-19 (see Exhibit 3). We believe the BLS seasonal factors are overfitting to the Omicron-related payroll deceleration in January 2022 (+500k mom sa, vs. +609k on average in 4Q21 and +714k in February 2022)."

This is how Goldman showed the seasonal "hurdle" (i.e., fudge factor) going into the January print...

... and the the final adjustment factor: +517K seasonally adjusted number vs -2.505 million unadjusted, which brings us to a record 3+ million seasonal adjustment factor.

And that, dear readers, is how you convert a 2.5 million plunge in jobs into a 517K, market blow-out 9-sigma payrolls beat, which moments ago allowed Biden to brag on TV just how strong his economy truly is...

No comments:

Post a Comment