Rising gas prices, Keystone XL and the real solutions

with Steve Kretzmann

with Steve Kretzmann

Much is being written and said about rising gas prices, Obama’s energy policies in general and the Keystone XL pipeline in particular. While the President’s opponents repeat ad infinitum the “Drill Baby Drill” mantra, it has been interesting to note that much of the mainstream press has been skeptical. And so they should be.

Unsurprisingly, the President’s critics have honed in on the Keystone XL pipeline and the President’s denial of that project’s permit in a frenzy of finger pointing over the gas price rise. This not only ignores the true cause of rising gas prices but also ignores two key facts.

First, the Keystone XL pipeline will do nothing to lower gas prices in America.

Second, the President’s action on vehicle efficiency will save more oil than Keystone will ever pump.

These points go right to the heart of the gas price debate. Only efficiency and diversification away from oil can ease the pain at the pump by reducing the American consumer’s exposure to the inevitable rising price of oil. Further, we can make a difference through demand reduction, not just in 5, 10 or 15 years from now, but this year.

Keystone XL and gas prices: where is the evidence?

Keystone XL’s proponents claim the pipeline will reduce gas prices in America, some going so far as to say 20-30 cents could be knocked off the price of a gallon of gas as a direct result of building the pipeline.

When we look at the evidence, there simply isn’t any that would indicate that gas prices would decrease as a result of building Keystone XL. The problem with arguing that another pipeline from Canada to the United States will reduce gas prices is that we have six pipelines from Canada already and so far the impact on U.S. gas prices is negligible.

Canada has been America’s top source of petroleum imports since 2005. According to the latest figures, in November the U.S. imported over 2.3 million barrels per day of crude and products from Canada. This was nearly 30% of all petroleum imports and nearly 13% of total oil and oil products supplied. Yet because of global events, including the heightened tensions with Iran, ongoing production problems in Libya, the shut-in of production in South Sudan and rising tensions in Nigeria, gas prices in the United States have been rising steadily and it is widely believed that prices will reach new highs this summer.

The six pipelines bringing Canadian oil into the United States, two of which were only built in the last 3 years, have a capacity of nearly 4 million barrels per day. (See Table 1 below) They are currently utilized at slightly over 50% so we actually have nearly 2 million barrels of spare capacity.

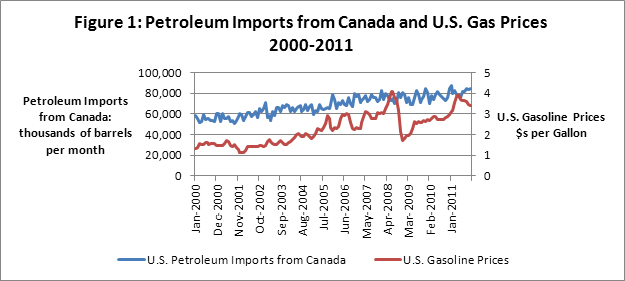

The increase in both the actual and the capacity for Canadian petroleum imports has not made the slightest difference to the general trend of rising oil and gasoline prices. (See Figure 1 below) This is not a surprise. Oil is a global commodity and there are simply bigger things going on in the oil world than the steady increase in Canadian oil production. The problems mentioned above have a greater influence on global prices, as does the steady increase in demand in emerging economies. That a seventh pipeline (Keystone XL) from Canada to America can make a significant impact just does not bear serious scrutiny.

| Table 1: The total capacity of Oil Pipelines from Canada to the United States | |

| Pipeline | Capacity (barrels per day) |

| Express | 280,000 |

| Bow/Milk River | 129,000 |

| Rangeland | 83,000 |

| Enbridge Mainline | 2,050,000 |

| Enbridge Alberta Clipper | 800,000 |

| TransCanada Keystone I | 590,000 |

| Total | 3,932,000 |

Figure 1 shows that throughout the last 11 years, petroleum imports from Canada have steadily risen from below 60 million barrels per month at the beginning of the last decade to over 87 million barrels per month at its peak in early 2011, a 50% increase. Yet, gas prices have trebled with spikes and troughs along the way that clearly have little to do with the steady rise in imports from north of the border.

Exports: where the oil goes matters

Another factor that undermines the assertion that building a seventh pipeline from Canada will somehow change this dynamic is the nature of the market in the Gulf Coast where the pipeline would terminate.

As we have discussed several times before on this blog, the Gulf Coast is becoming a refining center as much focused on exports as it is on supplying the domestic market. It is therefore unclear how much of the pipeline’s deliveries will actually make it onto the domestic market. This makes it even less likely that this pipeline will be any better than the six others at affecting U.S. gas prices.

The latest figures for exports from the refining area known as PADD 3, which encompasses all of Texas, Louisiana, Arkansas and New Mexico, show that 32% of the region’s production of finished petroleum products was exported in November.

So while the industry and its supporters ply their misinformation regarding the gas price reducing attributes of their pet project, it is worth noting that the real action that has been taken to ease the pain of inevitable oil price rises over the coming years is mostly being ignored.

Efficiency: where the real action is at

The fuel efficiency standards passed by the administration will save more oil than Keystone XL will ever pump. They could cut oil use by 2.2 million barrels per day in 2025 while Keystone would at full capacity deliver 830,000. These efficiency programs will save Americans billions of dollars at the pump and genuinely ease the pressure of spiking global oil prices. There is a lot more that can be done to reduce America’s dependence on oil, but these standards are a great start.

But while more efficient vehicles mandated under the new standards are entering the market this year, obviously only a small percentage of the population will be able to make use of them this summer when prices are expected to spike.

What appears to be missing from the discussion on both sides is a plan for action to help consumers deal with this year’s price spike. We know it’s coming but where’s the plan to deal with it?

President Obama has pointed to the pay roll tax extension as a help, but that is merely a continuation of tax policy that consumers have been enjoying for some time, welcome though it may be. Others have called for releases from the Strategic Petroleum Reserve, a band aid at best.

What we should be seeing is a concerted effort to help people reduce their oil use through every means available. Online tools for carpooling, incentives from employers, private and public, to use them. Increasing public transit provision where possible and providing information and incentives for those that can make use of transit; these are just a few examples that could make a big difference this year. We need to see recognition and action from local authorities and major employers that gas prices will be a problem for the public this year and that there are actions that can be taken.

When gas prices spiked in 2007-2008, Americans took to transit and carpooling in large enough numbers to precipitate the first dip in vehicle miles travelled in nearly thirty years and the biggest spike in transit use since the 1950s. This is bound to happen again this year but there is surely more we can do to facilitate it and after all, it is not just a short term salve but a major part of the long term solution.

No comments:

Post a Comment