Tax brackets and rates for individuals

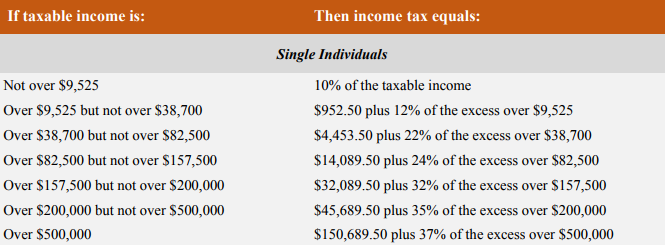

The number of tax brackets remains the same, but most income ranges will see decreases in rates and, in many cases, overall tax burden. Notably, the top tax rate is reduced from 39.6 percent to 37 percent.

Here’s the breakdown under current law (full tables from the joint House-Senate conference committee here):

And here’s the breakdown under the new bill:

Standard deduction and exemptions for individuals

The standard deduction nearly doubles under the bill -- from $6,500 for individuals to $12,000, and from $13,000 to to $24,000 for joint returns. This will mean that fewer taxpayers will have to itemize in order to reduce their tax burden. However, the personal and dependent exemption -- which had been $4,150 and indexed for inflation -- is repealed, shrinking the benefit of the higher standard deduction for many taxpayers. These provisions sunset after 2025.

Child and dependent tax credits

Families will get additional child tax credits, and a portion will be refundable for households that do not earn enough to pay taxes. The tax credit for each child under 17 will double from $1,000 to $2,000, plus $500 for non-child dependents. It also applies to more affluent families than previously, phasing out at $400,000 rather than the current $110,000 for joint filers. These provisions sunset after 2025.

Alternative minimum tax for individuals

Fewer households will face the alternative minimum tax -- a separate tax calculation that ensures that individuals with extensive deductions still pay a minimum amount of tax. Currently, the tax kicks in at $164,000 for joint filers. That will go up to $1 million. The provision sunsets after 2025.

State and local tax deduction

Residents in higher-tax states will be hurt by changes to the state and local tax deduction. The amount that can be deducted previously had been unlimited, but it will now be capped at $10,000. The provision sunsets after 2025.

Mortgage interest deduction

Residents of jurisdictions with more expensive real estate will be hurt by changes to the mortgage-interest deduction. Previously, interest on mortgages with up to $1.1 million in debt were allowable. That cutoff will shrink to $750,000 for new mortgages. The provision sunsets after 2025.

Affordable Care Act penalty for not having health insurance

The measure ends the penalty for not having health insurance.

Estate taxes

The estate tax will remain in place, but the amount shielded from the tax will be doubled, meaning that even fewer estates will be hit by the tax. It will affect estates of at least $11.2 million, or $22.4 million for couples. The provision sunsets after 2025.

Indexing for inflation

The new bill continues to index for inflation in several key provisions, but the new increases will be calculated using a more restrictive formula. This means that year-by-year inflation increases will be smaller than they would have been under the current formula.

Corporate taxation

The on-the-books corporate tax rate will come down significantly. (The tax that companies have been paying after deductions and credits are taken into account has often been lower than the on-the-books rate.) The top corporate rate will fall from 35 percent to 21 percent, and the business version of the alternative minimum tax will be repealed.

Pass-through taxation

Taxpayers who have some or all of their business income taxed on their individual return stand to benefit. Such "pass-through" income -- which includes S corporations, LLCs, partnerships and sole proprietorships -- could qualify for a 20 percent tax-free deduction, with the top rate dropping from 39.6 percent to 29.6 percent. This provision sunsets after 2025.

International business taxation

Some companies store income overseas -- rather than bringing it home -- for fear of incurring relatively high U.S. tax rates. Under the bill, such companies will get a tax break that nudges them to bring those funds home. Specifically, U.S. businesses that are holding assets overseas would be allowed to "repatriate" those assets at 8 percent, or 15.5 percent for liquid assets.

What does not change significantly

After some white knuckles during earlier deliberations, students and those with family members who have significant medical bills won’t see major changes with targeted deductions. Education tax provisions -- such as the American opportunity tax credit, the lifetime learning credit, and the student loan interest deduction -- remain in place. So does the medical expense deduction; it has even been made more accessible for taxpayers in 2017 and 2018.

House Ways and Means Committee Chairman Kevin Brady, R-Texas, arrives to update reporters at the Capitol after Republicans signed the conference committee report to advance the GOP tax bill, Dec. 15, 2017. (AP/J. Scott Applewhite)

The number of tax brackets remains the same, but most income ranges will see decreases in rates and, in many cases, overall tax burden. Notably, the top tax rate is reduced from 39.6 percent to 37 percent.

Here’s the breakdown under current law (full tables from the joint House-Senate conference committee here):

And here’s the breakdown under the new bill:

Standard deduction and exemptions for individuals

The standard deduction nearly doubles under the bill -- from $6,500 for individuals to $12,000, and from $13,000 to to $24,000 for joint returns. This will mean that fewer taxpayers will have to itemize in order to reduce their tax burden. However, the personal and dependent exemption -- which had been $4,150 and indexed for inflation -- is repealed, shrinking the benefit of the higher standard deduction for many taxpayers. These provisions sunset after 2025.

Child and dependent tax credits

Families will get additional child tax credits, and a portion will be refundable for households that do not earn enough to pay taxes. The tax credit for each child under 17 will double from $1,000 to $2,000, plus $500 for non-child dependents. It also applies to more affluent families than previously, phasing out at $400,000 rather than the current $110,000 for joint filers. These provisions sunset after 2025.

Alternative minimum tax for individuals

Fewer households will face the alternative minimum tax -- a separate tax calculation that ensures that individuals with extensive deductions still pay a minimum amount of tax. Currently, the tax kicks in at $164,000 for joint filers. That will go up to $1 million. The provision sunsets after 2025.

State and local tax deduction

Residents in higher-tax states will be hurt by changes to the state and local tax deduction. The amount that can be deducted previously had been unlimited, but it will now be capped at $10,000. The provision sunsets after 2025.

Mortgage interest deduction

Residents of jurisdictions with more expensive real estate will be hurt by changes to the mortgage-interest deduction. Previously, interest on mortgages with up to $1.1 million in debt were allowable. That cutoff will shrink to $750,000 for new mortgages. The provision sunsets after 2025.

Affordable Care Act penalty for not having health insurance

The measure ends the penalty for not having health insurance.

Estate taxes

The estate tax will remain in place, but the amount shielded from the tax will be doubled, meaning that even fewer estates will be hit by the tax. It will affect estates of at least $11.2 million, or $22.4 million for couples. The provision sunsets after 2025.

Indexing for inflation

The new bill continues to index for inflation in several key provisions, but the new increases will be calculated using a more restrictive formula. This means that year-by-year inflation increases will be smaller than they would have been under the current formula.

Corporate taxation

The on-the-books corporate tax rate will come down significantly. (The tax that companies have been paying after deductions and credits are taken into account has often been lower than the on-the-books rate.) The top corporate rate will fall from 35 percent to 21 percent, and the business version of the alternative minimum tax will be repealed.

Pass-through taxation

Taxpayers who have some or all of their business income taxed on their individual return stand to benefit. Such "pass-through" income -- which includes S corporations, LLCs, partnerships and sole proprietorships -- could qualify for a 20 percent tax-free deduction, with the top rate dropping from 39.6 percent to 29.6 percent. This provision sunsets after 2025.

International business taxation

Some companies store income overseas -- rather than bringing it home -- for fear of incurring relatively high U.S. tax rates. Under the bill, such companies will get a tax break that nudges them to bring those funds home. Specifically, U.S. businesses that are holding assets overseas would be allowed to "repatriate" those assets at 8 percent, or 15.5 percent for liquid assets.

What does not change significantly

After some white knuckles during earlier deliberations, students and those with family members who have significant medical bills won’t see major changes with targeted deductions. Education tax provisions -- such as the American opportunity tax credit, the lifetime learning credit, and the student loan interest deduction -- remain in place. So does the medical expense deduction; it has even been made more accessible for taxpayers in 2017 and 2018.

House Ways and Means Committee Chairman Kevin Brady, R-Texas, arrives to update reporters at the Capitol after Republicans signed the conference committee report to advance the GOP tax bill, Dec. 15, 2017. (AP/J. Scott Applewhite)

No comments:

Post a Comment