Proposals to adopt single-payer health care in the United

States have grown in popularity in recent years, as numerous lawmakers

and presidential candidates have embraced Medicare for All. However, few

have grappled with how to finance the new costs imposed on the federal

government. By most estimates, Medicare for All would cost the federal

government about $30 trillion over the next decade. How this cost is

financed would have considerable distributional, economic, and policy

implications.

In the coming months, the Committee for a Responsible Federal Budget

will publish a detailed analysis describing numerous ways to finance

Medicare for All and the consequences and trade-offs associated with

each choice. This paper provides our

preliminary estimates of

the magnitude of each potential change and a brief discussion of the

types of trade-offs policymakers will need to consider.

We find that Medicare for All could be financed with:

A 32 percent payroll tax

A 25 percent income surtax

A 42 percent value-added tax (VAT)

A mandatory public premium

averaging $7,500 per capita – the equivalent of $12,000 per individual

not otherwise on public insurance

More than doubling all individual and corporate income tax rates

An 80 percent reduction in non-health federal spending

A 108 percent of Gross Domestic Product (GDP) increase in the national debt

Impossibly high taxes on high earners, corporations, and the financial sector

A combination of approaches

Each of these choices would have consequences for the distribution of

income, growth in the economy, and ability to raise new revenue. Some

of these consequences could be balanced against each other by adopting a

combination approach that includes smaller versions of several of the

options as well as additional policies.

Consequences could also be mitigated through aggressive efforts to

lower per-person health care costs and/or by substantially scaling back

the generosity or comprehensiveness of Medicare for All.

The Cost of Medicare for All

Though it is a somewhat amorphous term, the term Medicare for All has

come to represent proposals that offer universal, single-payer health

insurance coverage for virtually all health care services (including

dental, vision, and long-term care) with no meaningful premiums,

deductibles, copayments, or restrictive networks.

In theory, Medicare for All may increase or decrease national health

expenditures, which is the total amount spent on health care by all

private and public sources. Cost increases would come from covering

those who are currently uninsured; expanding coverage to include

services like dental, vision, and long-term care; and eliminating

deductibles and copayments that currently help curb utilization. Cost

reductions would come from lower administrative costs and significantly

lower payments to medical providers and drug manufacturers.

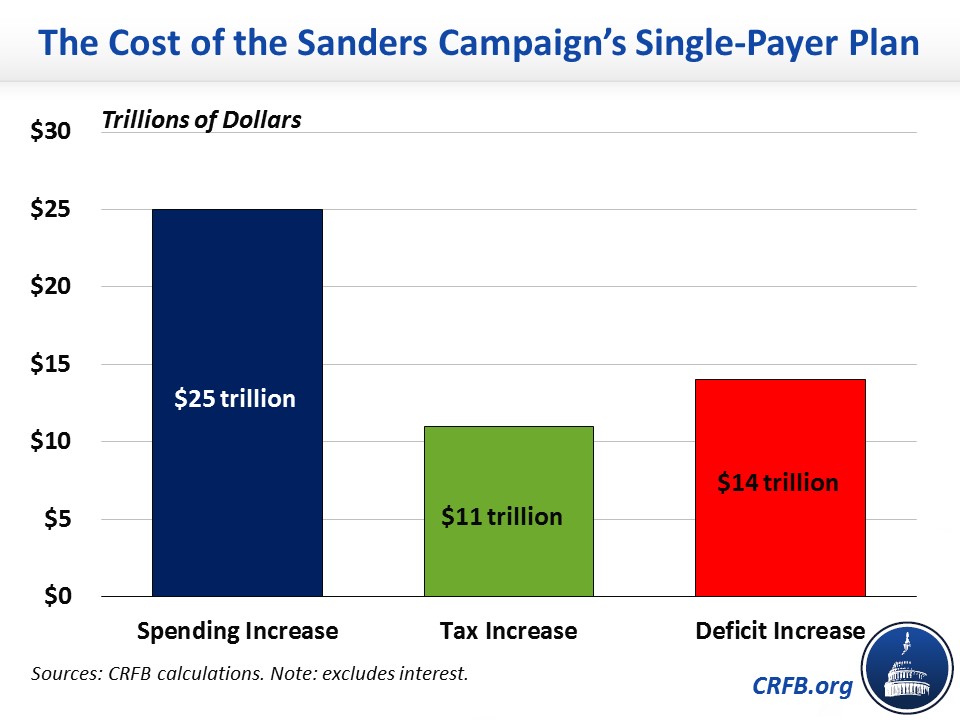

Regardless of the impact on total national health expenditures,

adopting Medicare for All would mean shifting virtually all private

health costs to the federal government. Most independent estimates of

Medicare for All find it would cost the federal government $25 trillion

to $36 trillion over ten years (though not all incorporate long-term

care coverage). Most recently, the

Urban Institute

estimated Medicare for All would cost $34 trillion over the next

decade, or $32 trillion net of income tax effects. These estimates

represent additional costs on top of the $16 trillion the federal

government is already projected to spend on major health programs over

the next decade.

The bulk of this expense represents the direct cost of eliminating

premiums, copayments, and other out-of-pocket costs. That spending will

total nearly $2 trillion this year alone. Replacing it will require

significant new funds regardless of changes to national health

expenditures.

Options for Financing Medicare for All

For the purpose of our analysis, we assume Medicare for All would

cost $30 trillion over the next decade net of new revenue – roughly the

midpoint of a variety of estimates. Though much of this cost represents

savings to the private sector, it nonetheless needs to be financed

through higher taxes, lower spending, more borrowing, or some

combination of the three.

Our estimates are rough and preliminary, do not account for economic

feedback, and may change modestly in our final analysis. Importantly,

the options we present are illustrative rather than prescriptive. Their

economic, distributional, and other consequences should be weighed

relative to each other and against the effects of eliminating all

premiums and out-of-pocket spending and providing comprehensive,

universal health coverage through the federal government.

We estimate that policymakers could finance Medicare for All over the next decade in any of the following ways:

1

Impose a 32 percent payroll tax.

Currently, most wage income is subject to a 15.3 percent payroll tax

divided evenly between workers and employers to fund Social Security and

Medicare. Wages above $133,000 are subject to either a 2.9 percent or

3.8 percent payroll tax to fund Medicare. We estimate a new 32 percent

payroll tax, divided evenly between workers and employers, would raise

roughly $30 trillion over a decade. This tax would apply to all wages,

not just those below a taxable maximum. An equivalent amount of revenue

could be raised with a 23 percent payroll tax on the employee side only

or a 48 percent tax on the employer side.

2

A 32 percent payroll tax would raise the total payroll tax rate on most

wage income to above 47 percent and the rate for high-wage earners to

nearly 36 percent. It would apply to all earned income.

Establish a 25 percent income surtax on adjusted gross income (AGI) above the standard deduction. Under

current law, households pay taxes on their income under a progressive

rate structure that ranges from 10 percent to 37 percent, with

preferential rates for long-term capital gains and qualified dividends

as well as deductions for mortgage interest, charitable giving, state

and local taxes up to $10,000, pass-through business income, and other

purposes. There is also a standard deduction of $12,200 for individuals

and $24,400 for married couples. We estimate a 25 percent income surtax

above the standard deduction threshold – which would apply to all AGI

without deductions or preferences – would raise roughly $30 trillion

over a decade.

3

This surtax would effectively increase the bottom income tax rate from

10 to 35 percent, the top income tax rate from 37 to 62 percent, and the

top capital gains and dividends rate from 24 to 49 percent.

Enact a 42 percent value-added tax (VAT). Whereas

most developed countries raise a substantial share of their revenue

through a tax on consumption – known as a VAT – the United States only

taxes consumption broadly through state and local sales taxes. A VAT

could be introduced at the federal level to finance Medicare for All.

Based on

estimates

from the Congressional Budget Office (CBO), we project a broad-based

VAT of 42 percent would raise about $30 trillion over a decade. The

first-order effect of this VAT would be to increase the prices of most

goods and services by 42 percent; the VAT would thus represent 30

percent of costs on a tax-inclusive basis, which is more comparable to

an equivalent income or payroll tax rate increase. Importantly, a VAT

can be designed in a number of different ways, and a different tax base

would change the required tax rate.

Require a mandatory public premium

averaging $7,500 per capita – the equivalent of $12,000 per individual

not otherwise on public insurance. Currently, most Americans

are charged health insurance premiums – the majority of which are paid

by employers on their behalf. Though current Medicare for All proposals

call for ending premiums, policymakers could consider financing Medicare

for All through mandatory fixed-dollar payments to the federal

government. These payments would be a form of head tax but could

resemble premiums in a number of ways. For example, they could vary

based on household size and could be paid in part or in whole by

employers. They could also be reduced or waived for some individuals,

perhaps based on income. In 2021, we estimate those premiums would need

to average about $7,500 per capita or $20,000 per household (including

single-person households) and is the average applied to all individuals,

including retirees, children, and low-income individuals. As an

illustrative example, fully exempting everyone who would otherwise be on

Medicare, Medicaid, or CHIP would increase the premiums by over 60

percent to more than $12,000 per individual.

More than double all individual and corporate income tax rates.

Under current law, ordinary income is taxed under a progressive rate

structure with a bottom rate of 10 percent and a top rate of 37 percent,

while long-term capital gains and qualified dividends are taxed at a

top rate of 23.8 percent and corporate income at a rate of 21 percent.

Assuming capital gains are taxed at death and pass-through income is no

longer deductible,

4 we estimate that

doubling

all individual income tax rates would raise $20 trillion to $25

trillion over a decade, and doubling the corporate rate would raise

about $2 trillion. Some additional revenue would be needed on top of

these increases to reach $30 trillion in total revenue. This option

differs from the income surtax in a number of ways, especially because

it would represent a much smaller tax increase for lower-income

taxpayers. Under this scenario, the bottom ordinary income tax rate

would be raised to 20 percent, the top ordinary rate would be 74

percent, capital gains would be taxed at a top rate of 47.6 percent, and

the corporate tax rate would be 42 percent.

Reduce non-health federal spending by 80 percent.

The federal government is projected to spend $60 trillion over the next

decade, including $16 trillion on health care and $6 trillion on

interest costs. Accounting roughly for the taxation of certain federal

benefits, we estimate that financing the full cost of Medicare for All

with spending cuts would require cutting the remaining federal budget by

80 percent.

5

Cuts of this magnitude are unrealistically large and certainly could

not be imposed on a short timeline. For illustrative purposes, an 80

percent cut to Social Security would mean reducing the average new

benefit from about $18,000 per year to $3,600 per year, and an 80

percent cut to the military would mean, among other things, reducing the

number of soldiers and officers from about 1.3 million today to

270,000.

More than double the national debt to 205 percent of the economy. Federal

debt held by the public currently totals about $17 trillion, or 79

percent of GDP. Under current law, debt is projected to reach 97 percent

of GDP by 2030. Assuming no changes in projected interest rates or

economic growth, deficit-financing Medicare for All over the next decade

would require about $34 trillion of new borrowing including interest,

which is the equivalent of 108 percent of GDP by 2030. As a result, debt

would rise above 205 percent of GDP, more than double its currently

projected level. This would put debt in 2030 at almost five times its

historic average of 42 percent and nearly twice the historic record of

106 percent (set after World War II). Under this scenario, debt would

continue to grow rapidly beyond 2030.

Impose impossibly high taxes on high earners, corporations, and the financial sector. There

is not enough annual income available among higher earners to finance

the full cost of Medicare for All. On a static basis, even increasing

the top two income tax rates (applying to individuals making over

$204,000 per year and couples making over $408,000 per year) to 100

percent would not raise $30 trillion over a decade. In reality, a tax

increase that large would actually

lose revenue because it

would institute marginal tax rates above 100 percent when other taxes

are incorporated – effectively requiring people to

pay rather than be paid to work, earn business income, or sell capital assets. We previously

found

that an extremely aggressive package of tax hikes on high earners,

corporations, and the financial sector might cover one-third of the $30

trillion cost of Medicare for All. Our very rough estimates showed that

over the next decade raising the top two individual and pass-through

rates to 70 percent would raise about $2 trillion, phasing out most tax

breaks for higher earners (assuming that 70 percent top rate) could very

generously raise another $2 trillion, and doubling the corporate tax

rate would raise $2 trillion. We also found that a wealth tax or

“mark-to-market” capital gains taxation could raise $3 trillion, and the

combination of a financial transaction tax and a tax on large financial

institutions could raise about $1 trillion. Other taxes on high earners

and the wealthy could raise some additional funds.

Enact a combination of approaches. Rather

than identify a single revenue source to finance Medicare for All,

policymakers could combine several options. For example, one could

combine a 16 percent employer-side payroll tax with a public premium

averaging $3,000 per capita, $5 trillion of taxes on high earners and

corporations, and $1 trillion of spending cuts. Other small options,

such as a higher excise taxes on alcohol, tobacco, or sugary drinks,

could also be included, as could policies to require or encourage state

governments to contribute to offsetting the cost of Medicare for All. Adopting smaller versions of several policies may prove more viable than adopting any one policy in full.

While the financing options above are quite large in magnitude, they

could be reduced significantly by reducing the cost of Medicare for All

itself.

These cost reductions could be achieved in part by reforming or

reducing provider payments, improving care coordination, and identifying

policies to reduce excessive utilization of care. Our

Budget Offsets Bank

incudes numerous options to reduce the cost of traditional Medicare;

some of these options would save much more if applied to a comprehensive

Medicare for All program.

Cost reductions could also be achieved by scaling back the generosity

of a Medicare for All program. For example, the Urban Institute

recently

estimated

that a Medicare for All plan that required cost sharing to cover

between 5 and 20 percent of medical costs (depending on income) and

covered only core health benefits (not vision, dental, hearing, or

long-term services and supports) would cost the federal government half

as much per person as a comprehensive Medicare for All plan. A $15

trillion cost could be financed with a 15 percent payroll tax, as

compared to the 32 percent payroll tax required to fund $30 trillion.

Choices and Trade-Offs in Financing Medicare for All

Deciding how to finance Medicare for All involves weighing

significant trade-offs amongst options as well as relative to the

current system. Indeed, the design of Medicare for All financing may

have as much distributional, economic, and policy importance as the

adoption of Medicare for All itself.

While many Americans are enrolled in heavily subsidized Medicare,

Medicaid, or private insurance plans, the majority of Americans pay for

their health care through premiums (especially employer-paid premiums),

deductibles, copayments, and coinsurance.

While premiums and cost sharing are not a form of taxation, they do

share some features in common with a “head tax” – a fixed-dollar tax

imposed on every person. For those with employer-provided health

insurance especially, premiums generally remain fixed regardless of

changes in income. Like head taxes, insurance premiums would thus be

regressive if measured relative to income among those who pay them

(though many of the lowest earners on Medicaid or receiving exchange

subsidies pay little or no premiums). Also like a head tax, premiums are

economically efficient in the sense that they create very little

economic distortion and do not generally disincentivize more work,

investment, or productivity. Finally, because premiums and cost sharing

don’t affect marginal tax rates or returns to work and investment, they

have little effect on the government’s ability to raise revenue.

Any plan to replace current premiums and cost sharing must weigh how

the new finance scheme will impact income distribution, economic output,

and tax capacity. In the coming months, the Committee for a Responsible

Federal Budget will release a full report evaluating the various

effects of most of the options mentioned in this paper.

From a distributional standpoint, most of the options we put forward

above would be more progressive on average than current law, though the

impact would vary person to person and many of the options would

represent a cost increase for lower-income individuals and families who

currently benefit from Medicaid and exchange subsidies. Options would

differ in their distributional impact. To get a broad sense of how

distribution may differ,

a recent CBO study

shows that in 2016 the top income quintile (indirectly) paid less than

40 percent of employer-side health premiums, but they paid more than 85

percent of individual and corporate income taxes and would have paid

over 50 percent of a new flat payroll tax. The top percentile paid about

2 percent of premiums, but they paid over 40 percent of income taxes

and would have paid 10 percent of a new flat payroll tax.

At the same time, most of the options we present would shrink the

economy compared to the current system. The 32 percent payroll tax hike,

for example, would increase the effective marginal tax rate on labor by

about 23 percent after accounting for various interactions. Penn

Wharton Budget Model recently

estimated that an 11.25 percent payroll tax increase used to pay for a Universal Basic Income (UBI) would reduce GDP by 1.7 percent.

6

This suggests that financing Medicare for All with a payroll tax would

shrink the size of the economy by about 3.5 percent by 2030 – though the

actual effect may differ. This economic impact would be the equivalent

of a $3,200 reduction in per-person income and would result in a 6.5

percent reduction in hours worked – a 9 million person reduction in

full-time equivalent (FTE) workers in 2030.

Deficit-financing Medicare for All would be far more damaging to the

economy. Assuming that such a massive increase in the debt would not

roil financial markets or lead to high inflation, we estimate that a 108

percent of GDP increase in the federal debt would shrink the size of

the economy by roughly 5 percent in 2030 – the equivalent of a $4,500

reduction in per-person income – and far more in the following years.

This is a low-end estimate of economic impact because it implicitly

assumes few limits on the amount of foreign savings available to

purchase Treasury bonds. Because deficit-financing would have little

direct impact on the incentive to work, we estimate a 0.7 percent or 1

million FTE reduction in work hours by 2030.

An additional consideration is how much tax capacity any of these

financing options might leave for future policymakers aiming to raise

revenue to pay for new programs, fund existing ones, or reduce deficits.

The best economic literature suggests a revenue-maximizing tax rate of

between 63 and 73 percent,

7 after which further rate increases actually

lose revenue. Tax rates approaching these high levels would reduce the ability of policymakers to raise revenue in the future.

Under current law, the top effective marginal tax rate (accounting

for state and local taxes in a typical state) is about 48 percent. That

rate would rise to 69 percent after a 32 percent payroll tax hike (the

increase is smaller than the tax due to interactions with the tax base),

73 percent after a 25 percent income surtax, and 85 percent if income

tax rates were doubled. In other words, each of these options would

bring the top rate close to or above the revenue-maximizing rate.

Conclusion

Regardless of its impact on national health expenditures, Medicare

for All would shift substantial costs from the private sector to the

federal government. By most estimates, a comprehensive Medicare for All

plan that expands coverage to every U.S. resident for nearly all medical

services and eliminates premiums and cost sharing would cost the

federal government roughly $30 trillion over a decade.

Policymakers have a number of options available to finance the $30

trillion cost of Medicare for All, but each option would come with its

own set of trade-offs.

In this preliminary analysis, we estimate the cost could be covered

with a 32 percent payroll tax, a 25 percent income surtax, a 42 percent

value-added tax, or a public premium averaging $7,500 per capita or more

than $12,000 per individual who wouldn’t otherwise be enrolled in

Medicare, Medicaid, or CHIP. Medicare for All could also be paid for by

more than doubling individual and corporate income tax rates, reducing

federal spending by 80 percent, or increasing the national debt by 108

percent of GDP. Tax increases on high earners, corporations, and the

financial sector by themselves could not cover much more than one-third

of the cost of Medicare for All.

Rather than adopting any one of the proposals above, policymakers

could also consider a combination of approaches to finance Medicare for

All

. Reducing the cost, scope, or generosity of Medicare for All would also reduce the magnitude of needed financing.

In deciding how to finance Medicare for All

, policymakers

must consider the distributional, economic, and policy consequences of

replacing premiums and cost sharing with various alternatives. Most of

the options we put forward are more progressive on average than current

law but would shrink economic output and bring the top tax rate up to

its revenue-maximizing level – leaving little capacity for further

taxes.

This paper will be followed by a more detailed analysis of the various consequences of different financing options.

1

These figures represent rough estimates generated by the Committee for a

Responsible Federal Budget using our own models as well as a variety of

sources, including the

Open Source Policy Center’s Tax Brain, the

Congressional Budget Office, the

Joint Committee on Taxation, the

Centers for Medicare and Medicaid Services, and the

Tax Policy Center.

Estimates are from 2021 to 2030, exclude any macroeconomic effects, and

include only modest behavioral effects. All estimates assume that the

elimination of private health insurance premiums would lead to a

significant increase in taxable wages.

2

An employer-side payroll tax raises significantly less than an

employee-side tax because higher employer contributions lead them to pay

lower taxable wages. The result is lower revenue from current income

and payroll taxes as well as from the newly imposed payroll tax itself.

3

As part of this policy, we also assume all capital gains would be taxed

at death and with this surtax. Absent that assumption, capital gains

revenue would significantly

decline under this surtax.

4

Allowing households to deduct 20 percent of business income and step-up

the basis of assets held at death would require much higher rates and

would likely result in substantial tax avoidance. We therefore assume

any reasonable policy to increase tax rates so dramatically would close

off these and other avoidance techniques that could lead to large

revenue losses.

5

The replacement of Medicare, Medicaid, and most other federal health

spending is already assumed in cost estimates of Medicare for All. If

the cost of the new Medicare for All program were cut proportionally

with the rest of the budget, the total size of the cut would fall to 45

percent.

6

A payroll-tax-financed UBI should be economically similar to a payroll

tax financed Medicare for All, as both essentially raise the payroll tax

to finance a lump-sum payment.

7 Economists Mathias Trabandt and Harold Uhlig

estimate a revenue-maximizing rate of 63 percent, while economists Peter Diamond and Emmanuel Saez

estimate a revenue-maximizing rate of 73 percent.