Illinois imposing car trade-in tax on Jan. 1; Dealers call it double taxation

Illinois imposing car trade-in tax on Jan. 1; Dealers call it double taxation

The state collects no sales tax on trade-in value, but that

changes next year. Car dealers call the $60 million to be collected

‘double taxation’ because trade-ins were taxed when purchased.

Car dealers may have a busy New Year’s Eve if Illinoisans try to

beat a significant sales tax expansion on vehicle trade-ins that starts

in 2020.The state currently collects no sales tax on a car’s trade-in value, which acts as credit toward a new vehicle purchase. By law, sales tax only applies to the difference between trade-in value and the new vehicle’s purchase price.

That changes Jan. 1. Under Senate Bill 690, signed June 28 by Gov. J.B. Pritzker, state and local sales tax will be applied to any trade-in value above $10,000. The new tax is expected to cost Illinoisans $60 million a year – which was earmarked not for roads, but for vertical infrastructure such as new state buildings and renovations.

The least a driver looking to trade-in will face is 6.25% in sales tax, the state’s rate. Municipalities often add their own sales tax, averaging 2.49%. Statewide the average combined state and local sales tax is 8.74%, but it ranges as high as 10.25% in Chicago.

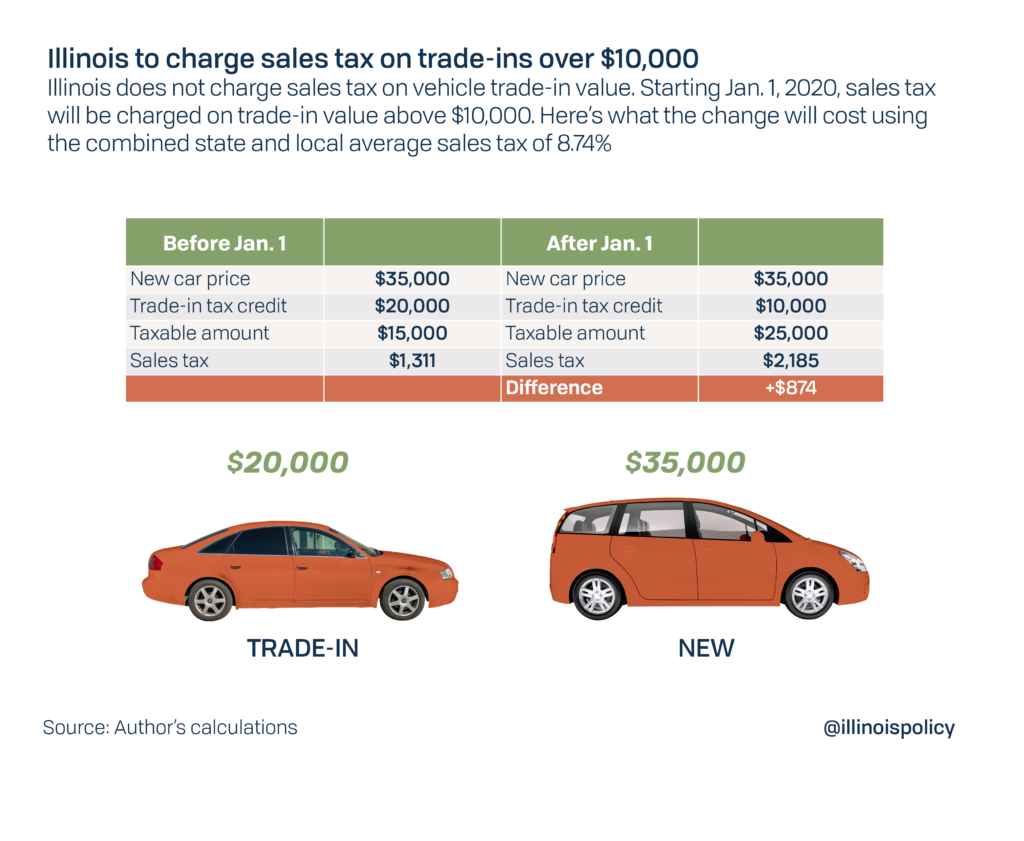

Take, for example, an Illinoisan buying a new vehicle for $35,000 – about the average cost in 2018 – and trading in her car valued at $20,000. Currently, she would only pay sales tax on the difference, or $15,000. The average sales tax on this transaction would be roughly $1,311.

In 2020, trade-in credit above $10,000 will be taxed in addition to the difference between the new and used car prices. In this example, the $20,000 trade-in will not be taxed on the first $10,000 in value, but the remaining $10,000 gets taxed along with the $15,000 difference between the new and used car values. So sales taxes will be applied to $25,000 of the transaction, which will cost her $2,185.

So the same car deal will cost her an extra $874 in sales taxes if she waits until Jan. 1.

The tax change also opens the door to double taxation for anyone with a trade worth more than $10,000.

“You already paid sales tax when you bought the vehicle first time around,” said Pete Sander, president of the Illinois Automobile Dealers Association.

While the tax change will hit everyone, it most affects those who like to trade their vehicle every year or two, Sander said.

Drivers already thinking about trading in their cars will “certainly take advantage” of the five-month window before the New Year, Sander said. There is some concern this shift in purchases will hurt sales in 2020, he noted.

While drivers can avoid Illinois’ doubled gasoline tax by buying across the state line, they can’t escape the trade-in tax because it applies to out-of-state purchases. State leaders passed 20 new or expanded taxes and fees to fund a $45 billion infrastructure bill and record $40 billion state budget.

Illinois’ motor fuel tax increase went into effect July 1, doubling the state gas tax to 38 cents and making Illinois’ pain at the pump No. 3 in the nation. Based on Illinois Policy Institute calculations, Illinoisans will pay $100 more in the first year under the 38-cents-per-gallon state gas tax. And now the gas tax is tied to inflation, meaning it will automatically rise in future years without requiring lawmaker approval. It is projected to hit 43.5 cents by 2025.

Illinois drivers will pay the nation’s highest base fee and fifth highest overall fee for vehicle registration, also meant to raise funds for Pritzker’s $45 billion infrastructure plan. Drivers of standard passenger cars will see registration fees jump from $98 to $148 in 2020. The $50 increase is estimated to raise $441 million in revenue. Registration fees for large vehicles – buses, trailers and semi-trucks – will increase by $100, raising $49 million in new revenue.

The gas tax hike and increased vehicle registration fees erase Pritzker’s promise of middle class income tax relief – a major selling point of his plan to replace Illinois’ constitutionally-protected flat income tax with a progressive income tax system. The progressive tax question will be before voters in November 2020.

Those 20 tax and fee hikes total $4.6 billion. Of that, $2.1 billion started hitting taxpayers July 1 and the rest kick in Jan. 1, including the trade-in tax.

As long as state lawmakers continue trying to tax their way out of Illinois’ fiscal mess, their credibility will remain somewhere well below that of a used car salesman swearing it was only driven by a little old lady to church on Sundays. Instead, they should be offering taxpayers an extended guarantee that they will pass meaningful reforms to put the brakes on spending and stop driving away residents.

No comments:

Post a Comment